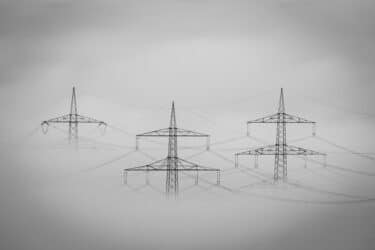

Southeastern Utilities Block Transmission Necessary for Decarbonization

Decarbonizing the economy will require a significant expansion of interstate and interregional transmission, but investor-owned utilities in the South, such as Southern Company and Entergy, have spent years undermining efforts...

Charities and groups funded or connected to APS filed comments in support of its $460 million rate hike request

Over 2,000 people submitted comments to the Arizona Corporation Commission (ACC) throughout Arizona Public Services’ (APS) rate case application, with many expressing frustration and anger with the utility’s proposed $460...

Blocking renewable energy is a top state legislative priority for network of pro-fossil fuels think tanks

The State Policy Network (SPN) announced on its website last month that it will focus on working with state lawmakers to prevent states from adopting wind and solar power in...

As Rate Case Approached, Avangrid’s CEO Tried to Improperly Influence CT’s Utility Regulator, Documents Allege

Shortly before requesting a substantial rate increase in August of 2022, the CEO of Avangrid, which owns gas and electric utilities in Connecticut, tried to improperly influence the state’s top...

Legislators backed by Dominion contributions to appoint Virginia utility commissioners

UPDATE, 3 pm EST Jan 23, 2024: The Virginia House Labor and Commerce Committee announced Tuesday morning that Sam Towell and Kelsey Bagot are likely to fill the SCC Judge...

Virginia bill would bar utilities from charging customers for politics, joining other states

A Virginia lawmaker introduced a bill last week that, if passed, would prohibit the utilities Dominion Energy and Appalachian Power from charging customers for many of their political activities. The...

Governor Lombardo prioritizes gas, eroding Nevada’s climate plan

Governor Joe Lombardo has eroded Nevada’s robust climate plan, one year into his first term. From appointing a fossil fuel executive to head the Office of Energy to pulling the...

Dominion Energy says data centers are “key industries” to the company but its South Carolina subsidiary may soon refuse them service

Dominion Energy South Carolina CEO Keller Kissam recently told lawmakers that he would be “fine” if the company did not pursue data centers as potential customers. But elsewhere within the...

Who’s who in former PUCO chairman Samuel Randazzo’s indictment?

A federal grand jury has indicted former Public Utilities Commission of Ohio chairman Samuel Randazzo on bribery and fraud charges. FirstEnergy is not named in the indictment, which was unsealed...