Utility Industry Contributions to Section 527 Political Organizations

Over 70 investor-owned utility holding companies and their subsidiaries have contributed more than $70 million from 2008 through 2022 to the Republican Governors Association, Republican Attorneys General Association, Republican State Leadership Committee, Democratic Governors Association, Democratic Attorneys General Association, and Democratic Legislative Campaign Committee, according to an Energy and Policy Institute analysis.

Utilities contributed over $11.9 million during the 2020 and $14.9 million in the 2022 election cycles to these six political organizations that then disbursed the monies to state candidates and political parties.

All six political organizations are registered as Section 527 political organizations by the Internal Revenue Service, which means they can accept unlimited donations from corporations or individuals.

View the full data here: https://docs.google.com/spreadsheets/d/1QZ1YdVI1R23_YBRzsaliw7kq2cTETA82oNX0HnI6yf8/edit?usp=sharing

The Republican Governors Association (RGA) is the largest recipient of the utility industry’s money. It has received over $31 million from utilities over the past 15 years. RGA received $3.7 million in the 2020 election cycle and $5.5 million in the 2022 cycle. NextEra Energy, Arizona Public Service, Dominion, Duke Energy, and American Electric Power are some of the most significant contributors to RGA.

Access to Public Officials

Investigative reports over the years have revealed how these organizations connect companies that contribute – depending on the size of the donation – to elected officials and their staff for private policy discussions.

For instance, in 2014, the New York Times revealed how then-Attorney General Scott Pruitt of Oklahoma and former U.S. EPA Administrator under President Trump, and other attorneys general had a “secretive alliance” through RAGA with some of the largest fossil fuel companies to fight clean air and water regulations.

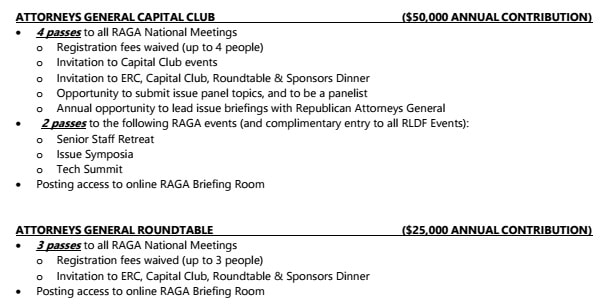

RAGA hosted its annual Winter National Meeting on February 25-26, 2018. According to a 2018 membership document published by Documented, companies that contribute $50,000 or $125,000 per year can lead private issue briefings with the Republican attorneys general. The $125,000 donors benefit from attending exclusive dinners and other events with other attorneys general. The Intercept has further revealed that RAGA also has a file-sharing website called “The Briefing Room” used to share policy documents. Donors who give more than $25,000 a year have “posting access.”

Utilities that have contributed over $50,000 in 2018 and likely could lead private issue briefings include the industry’s trade association, the Edison Electric Institute (EEI), and companies such as Arizona Public Service, Entergy, NextEra, and Southern Company. Entergy has contributed $125,000, which means they also could attend an exclusive dinner.

Meanwhile, the utilities that have contributed over $25,000 in 2018 and have access to the briefing room are Centerpoint Energy, FirstEnergy, and Vistra Energy.

CBS News also investigated RAGA and reported on their April 19-22, 2018 event at The Sanctuary on Kiawah Island, South Carolina. The agenda, obtained by CBS News, shows various resort activities, including yoga on the beach, golf, and a dolphin tour. “Rubbing shoulders with a state attorney general doesn’t come cheap. To get an invite to a four-day retreat, lobbyists had to fork over $125,000 … On a hidden camera, Georgia Attorney General Chris Carr can be heard saying, ‘We can’t do what we do without your help.'” CBS News also revealed that of 88 contributions to RAGA it reviewed, 46 of the donors had matters under consideration or had recently settled with an attorney general.

CBS News reported from a 2018 RAGA fundraiser in South Carolina: “On a hidden camera, Georgia Attorney General Chris Carr can be heard saying, ‘We can’t do what we do without your help.'”

Additional documents published by Documented detail the 2019 membership benefits. Individuals and companies that contributed over $125,000 – which would have included Louisiana-based Entergy – were invited to the annual “Edmund Randolph Club” retreat and had the opportunity to submit issue panel topics and be a panelist. The donors were also invited to RAGA staff policy retreats, an “Issue Symposia,” political conference calls, and monthly political briefings.

In 2017, the RGA hosted a “Corporate Policy Summit.” One of the first agenda items was an energy session where attendees were able to discuss with the Republican governors and staff how to continue the fight against regulations. Agendas from 2016 reveal other sessions where donors were able to meet privately at The Ritz-Carlton in Half Moon Bay California with governors and their staff to discuss topics ranging from energy portfolios, air quality, and federal regulations. And similar to RAGA, the RGA also has a private library allowing governors and their staff to access documents on “a variety of subjects provided by state and federal think tanks, leading industry specialists, and other recognized thought leaders.”

In 2018, HuffPost reported that the Democratic Legislative Campaign Committee (DLCC) hosted a conference in Portland, Maine where members who paid $35,000 or more were able to have one-on-one meetings with state legislators slated for 90 minutes. In addition to being able to privately meet with officials, donors were also able to participate with officials and staff in happy-hours, bowling, and dinners.

Funneling Money to Candidates

The Wall Street Journal detailed how RGA and DGA also help corporations funnel donations to candidates in states with finance-rules:

U.S. companies have found a loophole in state campaign-finance rules by funneling donations aimed at helping candidates through the RGA and its Democratic counterpart, according to multiple former officials. Donors can’t earmark money for a particular candidate. Instead, they can simply—and legally—tell the groups they have “an interest” in a race or are making a donation “at the request” of a gubernatorial candidate, these officials say … The RGA has a similar system, former RGA officials say.

In 2019, Virginia held general elections for all 40 seats of the Senate and all 100 seats in the House of Delegates. Virginia does not impose a limit on contributions, but Dominion’s cash became ‘toxic’ after years of influence and many candidates signed a pledge to refuse contributions from Dominion. Dominion still spent a record-breaking sum that cycle, but significantly increased their contributions to the RSLC and the DLCC. The RSLC and DLCC then contributed heavily to Virginia candidates. The RSLC spent more than $3 million in Virginia in 2019. Dominion’s contributions to the DLCC and RSLC in 2019 comprise 43% and 26% of the industry’s total contributions to the groups between 2019 to 2020, respectively.

-

- Top 5 Utility Contributions to Republican IRS 527 Political Organizations, 2008-2022:

- NextEra Energy/Florida Power & Light ($8 million)

- Duke Energy ($5.9 million)

- Dominion Energy ($3.3 million)

- Southern Company ($3.2 million)

- Arizona Public Service ($2.2 million)

-

- Top 5 Utility Contributions to Democratic IRS 527 Political Organizations, 2008-2022:

- NextEra Energy/Florida Power & Light ($3.6 million)

- Duke Energy ($2.9 million)

- Dominion Energy ($2.8 million)

- Southern Company ($2 million)

- Exelon ($1.6 million)

EPI analyzed the IRS Form 8872 filings made by the six organizations and the Center for Responsive Politics 527 Search database to compile the data.