Alabama Power has petitioned the Alabama Public Service Commission to buy a 743 MW gas-fired power plant in Calhoun County, Alabama, despite its parent company’s net-zero emissions target and sharply rising gas prices that risk driving up customers’ bills. Alabama Power’s move to purchase the plant, which is already in service and owned by an independent power producer, comes in addition to the utility’s plans to increase its gas generating capacity by almost 2,000 MW, which the Alabama Public Service Commission (PSC) approved in 2020. Alabama Power currently has an agreement to purchase power from the Calhoun plant, which is scheduled to end in 2022.

Alabama Power’s request for permission from the PSC to buy the Calhoun County gas plant did not specify what assumptions the utility used to project the future price of gas.

Alabama Power had previously called methane gas a “persistently” low-cost resource in a January 2020 filing with the Alabama PSC. At that time, the Henry Hub Spot Price, a commonly used metric for gas prices, was at $2.02 per MMBTU. By October of 2021, gas prices had soared to $5.51 per MMBTU.

In addition to risking bill increases for customers, the gas plant purchase by Alabama Power does not seem to comport with a goal set by its parent company, Southern Company, to reach “net-zero” emissions by 2050. The utility has defended its use of gas as part of its net-zero emissions target, despite the fact that burning methane gas in power plants emits carbon dioxide, and that methane leaks upstream of gas-fired power plants emit methane, a powerful greenhouse gas, into the atmosphere directly. The utility’s net-zero implementation plan, released in September 2020, showed that it would operate gas-fired power plants up to 2050 and Alabama Power received approval from the AlabamaPSC to operate a new gas-fired power plant as late as 2060.

Alabama Power’s moves to purchase power plants from independent power producers have raised questions of anti-competitive behavior, echoing a Department of Justice (DOJ) investigation of Entergy more than ten years ago that accused the utility of blocking competitors from selling power and later purchasing the power plants at artificially low costs. Entergy later joined a competitive market to alleviate the DOJ’s concerns. Alabama Power is not a member of a competitive market.

The Southern Renewable Energy Association (SREA) called Alabama Power’s 2020 gas acquisition spree “part of a holistic strategy by Southern Company to restrict market competition and acquire merchant natural gas power plants in the region.” SREA pointed to potential market manipulation concerns of the gas acquisitions in a proceeding at the Federal Energy Regulatory Commission.

Customers will pay for increasing gas prices

Multiple factors have caused the price of methane gas to soar in recent months in the U.S.; oil and gas producers have restricted supply after a decade of over-producing at a loss, and are using their returns to pay back debts and reward investors, rather than expand production again. The explosion in liquid methane [natural] gas exports in recent years has also tethered the commodity to the more expensive global market, driving up prices in the U.S. The resulting higher costs are putting more pressure on consumers just as electric utilities have increased their reliance on gas in recent years. Investor-owned utilities typically pass through all fuel costs directly to consumers, with their own shareholders bearing little or none of the risk if prices increase. The companies profit from constructing new gas-fired power plants regardless of what happens to the price of gas during a power plant’s lifespan.

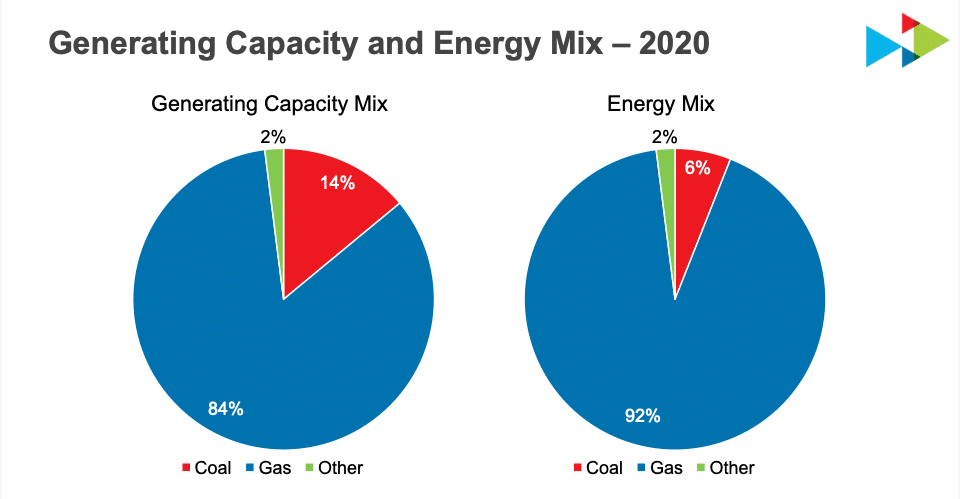

Risks to electric customers of gas price increases become more pronounced when the utility relies more on gas. Mississippi Power, one of Southern Company’s three electric subsidiaries, generated 92% of its electricity from burning methane gas in 2020. In a recent integrated resource plan (IRP), most of Mississippi Power’s future plans involved building even more gas-fired power plants. Georgia Power, another subsidiary of Southern Company, generated 50% of its electricity from burning methane gas in 2020.

When Alabama Power received approval from the PSC to build and buy almost 2,000 megawatts of new gas, local clean energy advocates and the Alabama Attorney General’s (AG) office told the Alabama Public Service Commission that new gas-fired power plants represented a high risk for creating stranded assets – or assets that would become liabilities or to expensive to operate before the end of their planned lives – especially considering that at least one of the plants was scheduled to run at least ten years beyond Southern Company’s net-zero emissions target. The AG’s office asked that Alabama Power’s investors be required to shoulder at least some of the potential burden of that risk, but the PSC ignored those requests.

Georgia Power has already requested a 15% increase to its fuel pass-through costs to customers, representing an increase of approximately $340 million on its customers’ bills. Georgia Power projects customers will still owe an additional $320 million for gas in May 2023, even with the 15% increase, and the utility “does not expect” the situation to “self-correct over the next 20 months.”

Southern Company also owns gas utilities like Atlanta Gas Light, Chattanooga Gas (in Tennessee), Nicor Gas (in Illinois) and Virginia Natural Gas, all of which sell gas directly to customers, primarily for heating. Those customers are likely to see even higher bill increases from the higher gas costs, compared to electric customers.

One long-term solution to defray those gas customers’ exposure to gas price volatility would be electrifying their buildings with super-efficient electric heat pumps. Despite being a Southern Company subsidiary that sells only electricity, and not gas, Georgia Power supported a 2020 bill in the Georgia legislature which banned municipalities from restricting gas use in buildings in any way, such as requiring new construction to be fully electrified. The bill passed.

Southern CEO’s GHG bonus still allows for new gas

Southern Company has set up an executive compensation structure which pays its CEO, Tom Fanning, for the addition of zero-carbon emitting resources, the retirement of coal-fired power plants, and the retirement of gas-fired power plants. The company added the incentive for retiring gas-fired power plants in 2020, after initially factoring only coal retirements and zero-carbon additions in Fanning’s compensation structure. Southern’s addition of the gas retirement language coincided with an order from its regulators in Mississippi, after a contentious proceeding, to retire older, rarely used gas-fired power plants in Mississippi, where the utility had built too much generation capacity after over-estimating electricity demand for years.

While Fanning’s pay structure will now give him a bonus for retiring those gas plants, the company’s planned addition of new gas-burning power plants will not factor into Fanning’s compensation at all. He can still receive his full bonus, which Southern has told investors is a “GHG reduction metric,” even if the company builds more methane gas-burning power plants, without penalty.

Banner photo courtesy Flickr: Jimmy Emerson, DVM

[…] Credit: Source link […]