Arizona’s largest investor-owned utility announced today that it will close its coal plants and increase its use of renewable energy over the next decade, ultimately aiming for 100% clean energy by 2050.

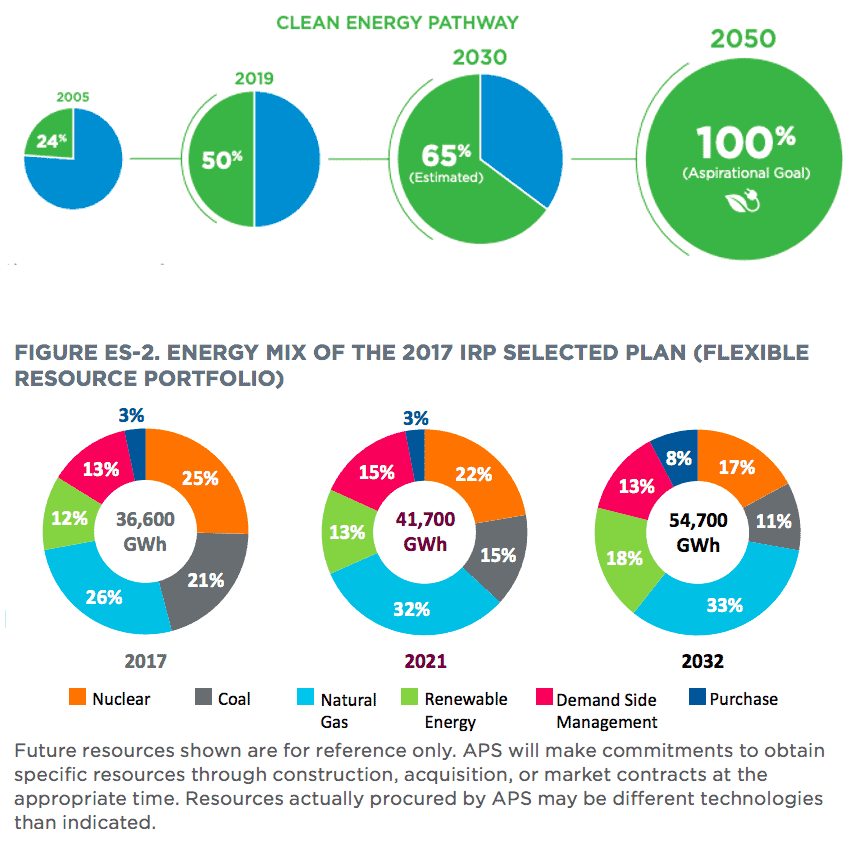

Arizona Public Service Company’s new clean energy goal “includes a nearer-term 2030 target of achieving a resource mix that is 65% clean energy, with 45% of our portfolio coming from renewable energy.” The company also said that it will “end all coal-fired generation by 2031, seven years sooner than previously projected.”

Until today’s announcement, APS was one of the few remaining major investor-owned utilities that had not established a goal to decarbonize its operations.

APS’ announcement says the company will increase its investments in solar and storage projects, and continue to operate the Palo Verde nuclear power plant. The utility made clear that it will ultimately eliminate fossil fuels from its power mix:

“In the near term, APS will use existing power sources such as coal and natural gas to maintain reliable service, but by 2031 we will no longer use coal and, ultimately, eliminate all fossil fuels.”

That commitment suggests that carbon capture and sequestration proposals will not play a role in APS’ decarbonization plans. In recent months, several executives of other utilities have explained why they are no longer interested in pursuing carbon capture and sequestration projects, pointing to its high costs and unproven technology while renewable energy prices continue to decline.

It also would seem to mark a dramatic shift from APS’ efforts under its previous CEO to build more gas-fired power plants. One major question is whether the company will seek to build any new gas plants when it submits its resource plan to the Arizona Corporation Commission this spring. Under the previous resource plan that APS proposed in 2017, APS proposed building 5,500 MW of new gas plants, and forecast that 35% of the electricity it sold in 2032 would come from zero-carbon resources, far less than today’s commitment of 65% by 2030. Regulators “refused to acknowledge” that 2017 plan, citing its reliance on gas. In an interview with the Arizona Republic about its new goal, APS CEO Jeff Guldner said “Let’s get our proposal out and have a constructive dialogue and compare plans.”

Bottom image: APS 2017 Integrated Resource Plan

APS also highlighted the opportunities that a clean electricity supply presents to electrify currently fossil-fuel based energy uses:

“As electricity gets cleaner, it makes sense to power more of Arizona with it, especially vehicles. This also supports affordable rates and efficient use of renewable energy.”

Financial analysts welcomed APS’ clean energy goal because of its potential to improve the company’s strained relationship with its regulators. The Washington Post reported:

“We see value in [Pinnacle West] under new leadership that is already taking tangible steps to improve the regulatory relationship in Arizona,” the electric utilities analysts at Credit Suisse said in a report to investors on Tuesday.

Recent reports by other financial analysts have highlighted how switching from coal to renewable energy can benefit both utility ratepayers and shareholders.

“It is gratifying that APS has made this announcement to decidedly move to build a carbon-free portfolio of energy. This move is welcomed and necessary for Arizona to be competitive with neighboring states and to address its carbon emissions. The next step is to secure this commitment for APS and other regulated utilities through the creation of a carbon standard by the Arizona Corporation Commission,” said Amanda Ormond, Director of Western Grid Group.

[…] appeared to be singing a different tune. A month later in January, APS’ new CEO Jeff Guldner committed the company to voluntarily meet a nearly identical goal to what Prop 127 would have mandated – 45 percent […]