The Inflation Reduction Act includes a major increase of the tax credits that subsidize carbon capture projects, as well as changes that weakened a key guardrail that was included in the earlier Build Back Better bill that would have required carbon capture projects at power plants to capture at least 75% of a facility’s emissions. That change followed lobbying against the 75% capture rate requirement by the Carbon Capture Coalition, whose members include coal, oil, and power companies.

Between the Inflation Reduction Act’s introduction on July 27 and its passage on August 7, another change further weakened those guardrails in a way that allows power companies to increase the output of coal and gas power plants after installing a carbon capture project in order to maximize revenue from the carbon capture tax credit, without increasing the size of the carbon capture facility.

Combined, the changes could allow power plant operators to receive generous taxpayer subsidies for carbon capture projects, even while increasing their greenhouse gas emissions.

Guardrails removed from carbon capture tax credits

The Inflation Reduction Act includes a significant increase in the 45Q tax credit, the main subsidy aimed at catalyzing carbon capture projects. The legislation increased the amount of the 45Q tax credit from $50/ton to $85/ton. If the captured carbon dioxide emissions are used for enhanced oil recovery (EOR), the tax credit increases from $35/ton to $60/ton.

The bill also creates a direct pay option for the carbon capture tax credit, which the bill did not create for clean energy tax credits for most taxpayers. In a letter to the West Virginia Coal Association, Senator Joe Manchin explained that he made that change specifically to benefit the coal industry:

The reality is I specifically ensured that the Inflation Reduction Act provides incentives that would benefit coal. That includes increasing the value of the 45Q CCUS tax credit and providing direct pay for the first 5 years to help fossil plants. This is in contrast to the electricity tax credits that benefit renewables, which do not have direct pay.

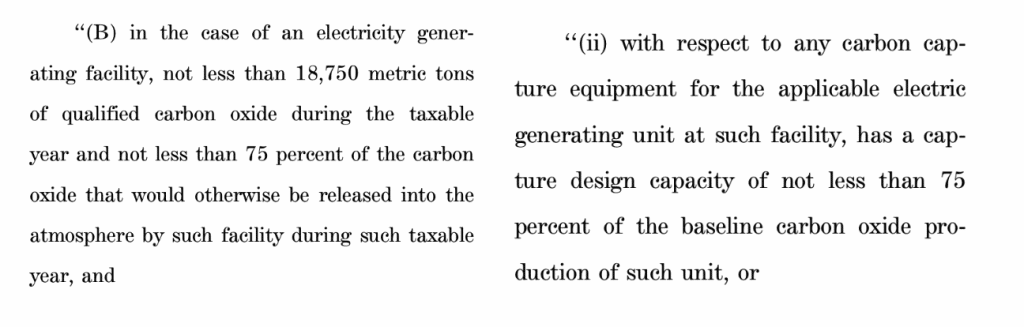

Many of the energy provisions of the Inflation Reduction Act derived from the earlier Build Back Better bill, passed by the House of Representatives in November 2021 but never taken up by the Senate due to Manchin’s opposition. The Build Back Better bill also increased the value of the 45Q carbon capture tax credits, but it paired those increases with a key guardrail to help ensure that the subsidies led to actual emissions reductions. To qualify for the carbon capture tax credit, Build Back Better would have required power plants to capture “not less than 75 percent of the carbon oxide that would otherwise be released into the atmosphere by such facility during such taxable year.”

That language was changed in the Inflation Reduction Act; instead of requiring the carbon capture project to actually capture 75% of a power plant’s emissions, the carbon capture project just has to have a “capture design capacity” of 75% of the baseline emissions.

Moreover, the Inflation Reduction Act language was also changed to apply at the unit level, instead of Build Back Better’s requirement that emissions be reduced at the facility level. That means that a power plant with multiple units could install carbon capture equipment on just one unit, receive subsidies through the 45Q tax credit, and continue to operate other units without carbon capture.

Those guardrails were further weakened during the week between introduction and passage of the Inflation Reduction Act, with a change to language that would have helped ensure a power plant operator can’t install a carbon capture facility designed to capture 75% of a coal unit’s historic emissions, but then run that coal unit more often and thereby increase emissions.

The version of the Inflation Reduction Act introduced on July 27 included language clarifying when the baseline emissions of a power plant unit, used to determine the 75% “capture design capacity” requirement, would need to be adjusted: if “modifications are made to such unit which result in a significant increase or decrease in carbon oxide production,” or “for any reason other than a modification described in subparagraph (A), there is a significant increase or decrease in carbon oxide production with respect to such unit.”

But in the final version of the Inflation Reduction Act, passed by the Senate on August 7, that language was changed to read: “adjust the baseline carbon oxide production with respect to any applicable electric generating unit at any electricity generating facility if, after the date in which the carbon capture equipment is placed in service, modifications which are chargeable to capital account are made to such unit which result in a significant increase or decrease in carbon oxide production.”

That means that a power plant operator could install a carbon capture facility at a coal unit that is “designed” to capture 75% of that unit’s historic emissions, but then run that coal unit more often and thereby increase its emissions – without needing to build a bigger carbon capture facility designed to capture 75% of those higher emissions. That would not have been possible with the language in the introduced version of the Inflation Reduction Act.

Sierra Club Senior Adviser Jeremy Fisher explained how the removal of those key guardrails could result in an increase in emissions:

So… the IRA enables half-assed carbon capture, and it looks like that’s an unfortunate possibility if we don’t get some serious guardrails to, uh, prevent coal plants from *increasing* emissions with CCS.

— Jeremy Fisher (@J_I_Fisher) August 19, 2022

Say what? Read on. (1/16)

Carbon Capture Coalition and coal interests lobbied against capture rate requirement

After the House of Representatives passed the Build Back Better bill and negotiations over the climate and spending package moved to the US Senate, the Carbon Capture Coalition and coal companies lobbied to remove the guardrail requiring power plants to capture 75% of emissions. But a spokesperson for the Carbon Capture Coalition told EPI that the group “did not propose replacement language.”

The Carbon Capture Coalition published a blog post criticizing the 75% capture rate requirement, which it later deleted. That post promoted a document that claims that the 75% capture rate requirement “will have no emissions benefit,” and for power plants, focused on concerns around applying the capture rate requirement to the entire facility, rather than each unit at a power plant:

Power plants often consist of several separate electric generating units. For projects to be commercially viable, 90%+ capture will typically be applied on the newest units with the longest remaining life but will not be applied on older units that may be close to retirement. Capture often will need to be applied one unit at a time to enable learning from each subsequent project, and so that entire power plants are not offline for long periods. Because this new provision would require the entire plant to install capture at the outset, it will completely prevent carbon capture at many power plants.

The Carbon Capture Coalition also distributed talking points against the 75% capture rate requirement, including in an email to Wyoming Governor staffers obtained by EPI through a public records request.

Other public statements from the Carbon Capture Coalition also criticized the “harmful new percentage carbon capture requirements applied at the level of the whole facility,” suggesting that the group’s concern was with applying the capture rate requirement to the facility, instead of to each unit.

But in a December 7, 2021 letter to Senators Ron Wyden, Chuck Shumer, and Joe Manchin, the Carbon Capture Coalition and several of its member companies lobbied against unit-level capture rate requirements as well, arguing that “a 75 percent minimum capture requirement for power plants on a facility-wide or per unit basis to claim the 45Q tax credit would severely limit the emissions reduction potential of the credit.”

Several coal companies and trade groups joined that letter, as E&E News reported:

Coal interests, for their part, have been vocal champions of removing the 75 percent requirement.

The letter to Manchin was signed by the National Mining Association and the Wyoming Mining Association, interest groups representing the coal industry, as well as coal plant operators like Basin Electric Power Cooperative and the Prairie State Generating Co.

Other companies pursuing coal carbon capture proposals also signed the letter, including Enchant Energy, the company seeking to take over the San Juan Generating Station in New Mexico in order to build a carbon capture project there, and Rainbow Energy, the company that purchased the largest coal plant in North Dakota to pursue a carbon capture project.

Two days later, environmental groups wrote to Senators to encourage them to strengthen the guardrails of the 45Q tax credit and the keep the capture rate requirement: “We request that you keep the 75% capture rate requirement for the power sector, eliminate the tax credit for carbon used in enhanced oil recovery, and ensure that facilities are not sited in disadvantaged communities.”

The Congressional Progressive Caucus also urged Senators to keep the 75% capture rate requirement:

The House-passed version of Build Back Better requires fossil fuel emitting plants to store 75 percent or more of their carbon pollution — an eminently reasonable requirement, as the fossil fuel industry itself touts carbon capture’s ability to achieve a 90 percent sequestration rate… It’s simple: a bill that aims to tackle climate change and rapidly decarbonize our economy cannot include gifts for polluters.

When Senators Manchin and Schumer introduced the Inflation Reduction Act in July, the 75% capture rate requirement was gone, replaced with the “capture design capacity” language. A spokesperson for the Carbon Capture Coalition said in an email to EPI that the group did not propose that language:

“The Carbon Capture Coalition did not propose replacement language. We are a consensus-based organization and therefore only weigh in as an organization upon policies and positions on which we have achieved consensus across the membership. That said, a broad range of power companies, environmental and conservation NGOs, and union stakeholders in the Coalition are supportive of the design capacity language included in the Inflation Reduction Act of 2022, which to our knowledge was designed to replace the facility-wide requirement. We believe that this policy achieves the same goal of the original facility-wide capture requirement with equal rigor, but in a way that minimizes investment risk.”

Members of the Carbon Capture Coalition include coal mining companies including Peabody Energy and Arch Resources, oil companies including Shell and Occidental, power companies including DTE Energy and NRG, and environmental groups including Clean Air Task Force and National Wildlife Federation. The group was originally called the National Enhanced Oil Recovery Initiative, but rebranded in 2018 after Congress increased the 45Q tax credit from $20/ton to $50/ton, and from $10/ton to $35/ton for enhanced oil recovery projects. In the process of the Carbon Capture Coalition’s winning that earlier increase of the subsidy, the Natural Resources Defense Council left the group because of disagreements over the expansion of the carbon capture subsidy for enhanced oil recovery projects.

Will changes to 45Q tax credits lead to carbon capture projects at coal plants?

It’s not clear whether the removal of guardrails on the 45Q tax credit will lead to more carbon capture proposals at coal plants, in part because the various third-party modeling efforts analyzing the Inflation Reduction Act did not incorporate those changes to the legislation into their models.

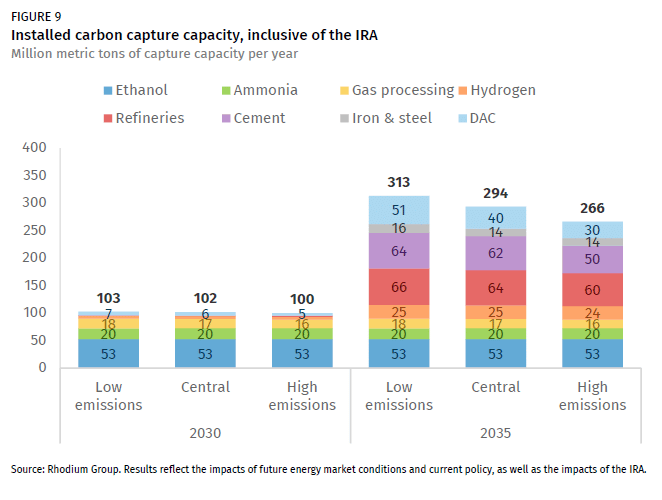

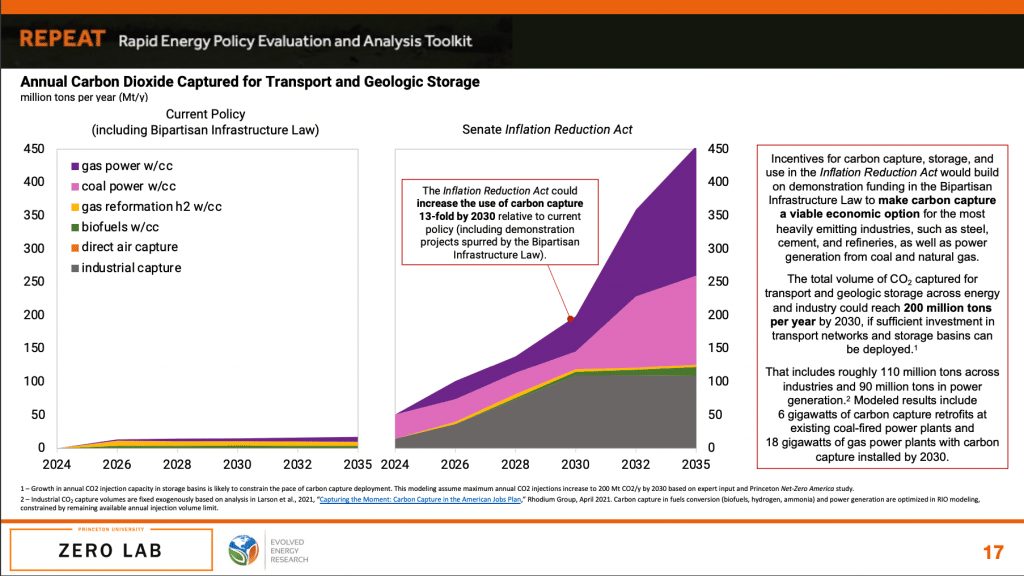

Organizations that modeled the impacts of the Inflation Reduction Act’s energy provisions include Rhodium Group, Princeton REPEAT Project, Energy Innovation, and Resources for the Future, and representatives from each group discussed their findings in an August 10 webinar. The presentations in that webinar showed that Resources for the Future did not model the impacts of higher 45Q tax credits, while Energy Innovation modeled the impacts of higher 45Q tax credits for the industrial sector, but not for the power sector. Rhodium Group and Princeton REPEAT Project modeled higher 45Q tax credits for the power sector and industrial sector.

Rhodium Group found that the higher 45Q tax credits will boost carbon capture projects in the industrial sector, but not in the power sector, as Rhodium Group Partner John Larsen explained in the webinar.

In an email, Larsen further explained: “For 2030 across all our scenarios we find zero carbon capture on new or existing fossil fuel fired power plants with the IRA in place. That holds for both natural gas and coal.” Larsen noted that “the enhanced tax credits for new clean generation and retention of nuclear plants makes that energy cheaper than a fossil plant with carbon capture even with enhanced 45q so capture just isn’t economically attractive.”

The Princeton REPEAT Project model, in contrast, found that the higher 45Q tax credits could lead to more carbon capture projects in both the industrial sector and the power sector, including for both gas and coal plants. But Professor Jesse Jenkins, who leads the Princeton REPEAT Project, explained that “the exact split across different sectors, industry and power, is about half and half in our modeling, but in reality it will depend on who can lock up those access to injection basins, and that’s hard for us to predict.”

But those models don’t account for the weakened guardrails for carbon capture projects at power plants, as Professor Jenkins acknowledged. Larsen did not specify whether Rhodium accounted for the weakened guardrails. In any case, it would be difficult for the models, which assume economically rational behavior by power plant operators and others, to reflect the weakened guardrails, which don’t directly change the economics of carbon capture projects. Instead, the weakened guardrails make carbon capture projects at power plants more likely by reducing the risks of developing the projects – including for power plant operators that may pursue carbon capture projects even if they are unlikely to be economic.

Most analyses of pathways to meet the Biden administration’s emissions reductions goals find that coal plants must be closed over the next decade, not retrofitted with carbon capture projects, including reports published by Lawrence Berkeley National Laboratory, Energy Innovation, Natural Resources Defense Council, Princeton University Net-Zero America, and Breakthrough Institute. The head of the US Department of Energy Office of Fossil Energy and Carbon Management, which funded coal carbon capture projects for decades, has also acknowledged that “it’s clear that carbon capture may not make economic sense on the remaining existing fleet of coal-fired power plants in the United States.”

Power companies will likely run coal plants more often after installing carbon capture

If a power company installed a carbon capture facility at a coal plant, the company would likely run it more often in order to maximize revenue from the 45Q tax credit.

In a filing submitted to the Wyoming Public Service Commission, Pacificorp explained that its initial assessment of carbon capture “assumed the units would be base-load (annual capacity factor of 85 percent) and may therefore not always be dispatched economically.” The filing was part of Pacificorp’s response to a Wyoming law that seeks to compel investor-owned utilities in the state to consider coal carbon capture projects instead of closing coal plants.

Similarly, Enchant Energy’s proposal to build a carbon capture at the San Juan Generating Station in New Mexico expects to run the coal plant more often. The company’s pre-feasibility study for the carbon capture project assumes an 85% capacity factor, up from 64% over the last three years. Nationally, coal plants averaged a 49% capacity factor in 2021.

Mike Eisenfeld with the San Juan Citizens Alliance said that Enchant Energy’s coal carbon capture proposal in New Mexico is “pushing this as a CO2 manufacturing facility,” generating emissions just to bury them.”

Increasing coal plant operations to boost 45Q tax revenue would increase impacts from mining and burning coal, many of which are not addressed by carbon capture. Some impacts, such as from coal ash waste and coal mining, are actually worsened significantly when a coal plant installs carbon capture technology, because coal carbon capture projects use more coal to generate the same amount of electricity. Those impacts can include local water pollution impacts, as well as the greenhouse gas emissions associated with mining; a report from the Institute for Energy Economics and Financial Analysis found that methane emissions from mining the coal used at the San Juan Generating Station account for a significant portion of lifecycle emissions.

Those pollution risks, and the stronger rules expected next year from the US Environmental Protection Agency to reduce air and water pollution from power plants, could dissuade coal plant operators from pursuing carbon capture projects, despite the increased carbon capture subsidies and weakened guardrails in the Inflation Reduction Act.

An executive of PNM, which operates the San Juan Generating Station, pointed to environmental rules when he explained the company’s decision to replace the coal plant with clean energy, instead of attempting to retrofit it with carbon capture:

At the end of the day, this technology would cost well over $1.5 billion, would need 80% more water than what we currently use, and would need 25% of the power it generates to be fed back into the operation to run the machinery. We simply cannot see environmental regulation sustaining these federal subsidies over the decades needed to recover the billion dollar investment.

PNM will close the San Juan Generating Station this week. But the prospect of higher carbon capture subsidies mean that the future of the coal plant is unclear; Enchant Energy and Farmington Electric Utility continue to try and take over the power plant, and last week announced a legal challenge seeking to force PNM to transfer ownership.

[…] Carbon Capture Coalition lobbied to weaken guardrails for expanded carbon capture subsidy Energy and Policy Institute […]

[…] Carbon capture provisions in the Inflation Reduction Act could allow power plant operators to receive taxpayer subsidies while increasing emissions. (Energy and Policy […]