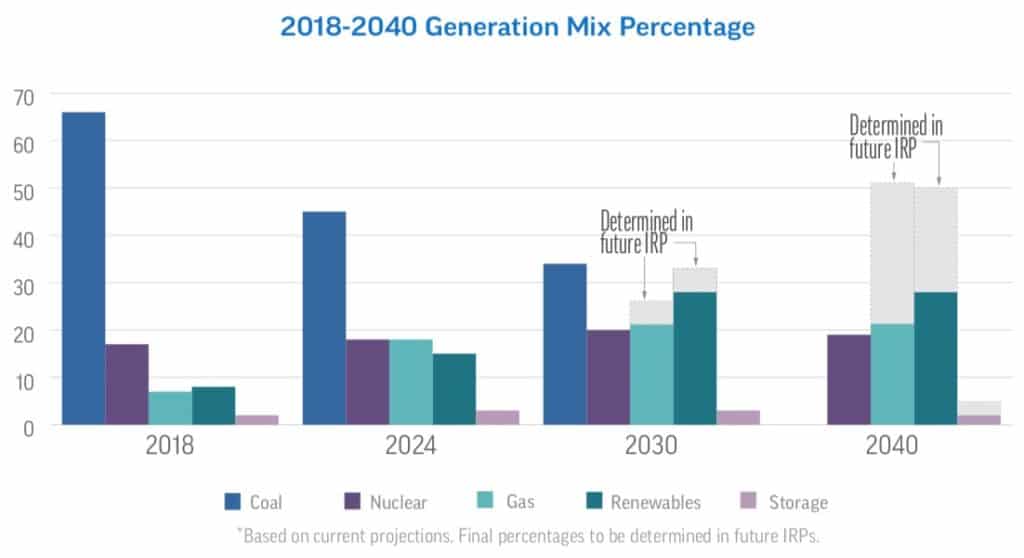

DTE Energy announced a plan to retire its coal-fired power plants by 2040 on Friday, but the utility is preserving the option to build more gas-burning power plants while the company’s pipelines business simultaneously invests billions of dollars in gas infrastructure.

DTE Energy’s CEO Gerry Anderson said that “he wouldn’t be surprised” if renewables comprise 50% of the company’s electricity portfolio also by 2040, but the utility will add only 525 MW of solar by 2030. DTE’s neighbor in Western Michigan, Consumers Energy, has also pledged to be coal-free by 2040, but it is developing 5,000 MW of solar on the same timeframe.

“[DTE] kicked the can down the road on just how much renewables it will add, while significantly increasing natural gas and decreasing coal,” Ben Inskeep, an Energy Policy Analyst for EQ Research, noted on Twitter.

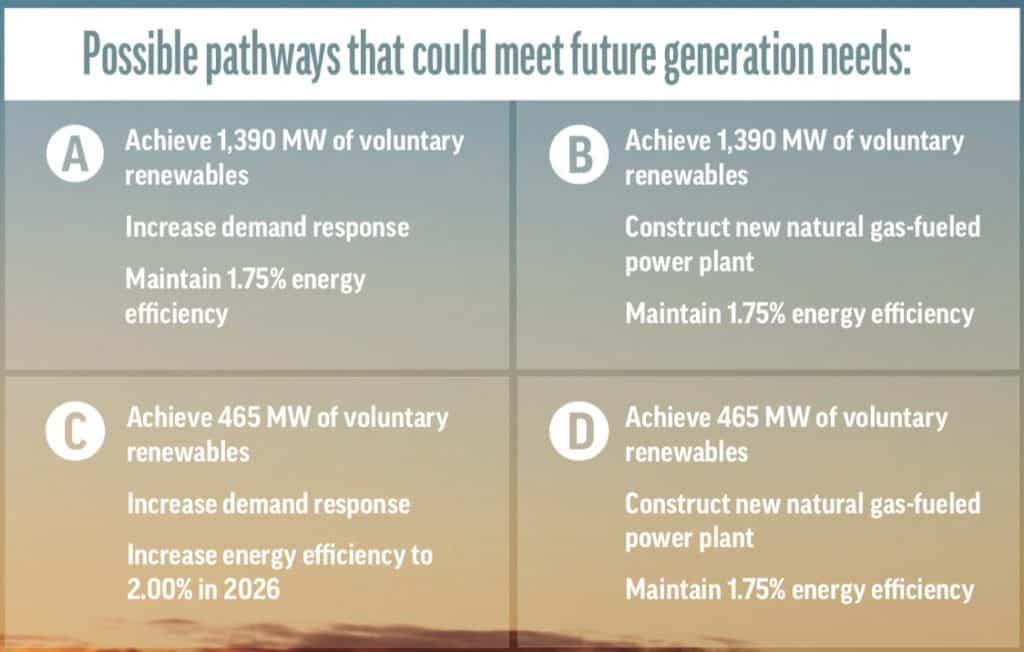

Inskeep and PV Magazine detailed several reasons why DTE plans to deploy a fraction of the solar compared to Consumers Energy. First, the “utility is expecting success in its efforts to make both the Public Utilities Regulatory Policy Act of 1978 (PURPA) unusable for solar developers and to kill rooftop solar.” Second, DTE forecasts that the price of solar will remain the same despite industry expectations that it will continue falling. Lastly, DTE says that it is concerned about integrating higher levels of renewable energy over the next 20 years. Inskeep told PV Magazine, “Overall, this sharply contrasts with the trends in the region, like what we have seen from NIPSCO (IN) and Consumers Energy (MI) in their recent IRPs.”

DTE Energy continues gas reliance compared to neighboring Consumers Energy

DTE Energy laid out its new plans in its Integrated Resource Plan (IRP), a new process in which Michigan’s utilities have to formally submit their long-term plans to their regulators at the Public Service Commission.

Consumers Energy laid out its vision in its own IRP that it filed with the Public Service Commission last year. In contrast to DTE’s, Consumers said that it would not build any new gas plants to replace the capacity from its coal phase-out, and planned far higher solar investments. Consumers Energy’s CEO Patti Poppe remarked about DTE’s gas plans:

“A big bet is a

On March 23, Consumers Energy, PSC staff, the Office of the Attorney General, and several environmental organizations reached a settlement agreement in the IRP proceeding, subject to approval by the PSC itself. If the PSC agrees, the utility will deploy 5,000 MW of solar capacity by 2030 and increase energy storage capacity all while not constructing new gas plants.

Along with its IRP, DTE Energy said that it would reduce its carbon emissions by 33% by 2023, by 50% by 2030, and by 80% by 2040, based on 2005 levels.

Those goals show an increased ambition from DTE’s previous carbon reduction goals, though it still places the company well short of industry leaders like Xcel and NIPSCO. Xcel, which mostly serves customers in Minnesota and Colorado but has serves several thousand customers in Michigan, plans to be carbon-free by 2050 despite a much higher current carbon footprint than DTE. Northern Indiana’s NIPSCO says it plans to reduce emissions at a far steeper rate: 90% by 2028 from 2005 levels, and is currently seeking regulatory approval to replace the capacity from its soon-to-be-retired coal plants with wind and solar.

The IRP has not earned praise from environmentalists.

“While DTE’s plan to reduce its massive carbon footprint shows improvement, it still involves building big, expensive natural gas plants over more cost-effective renewable energy and efficiency,” Nick Occhipinti, Michigan League of Conservation Voters’ director of government affairs, said

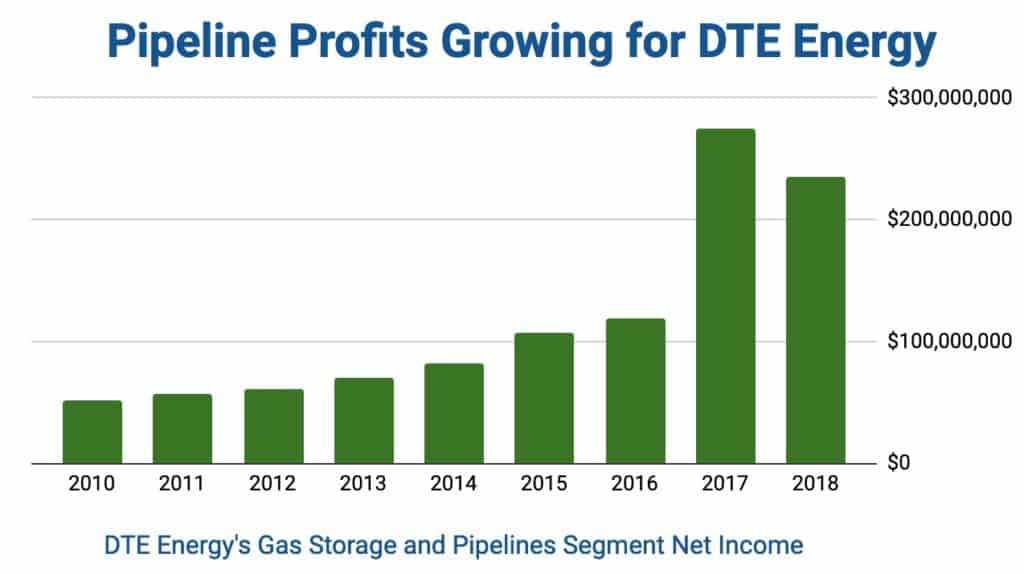

With billions already invested, natural gas remains key to DTE Energy’s future growth

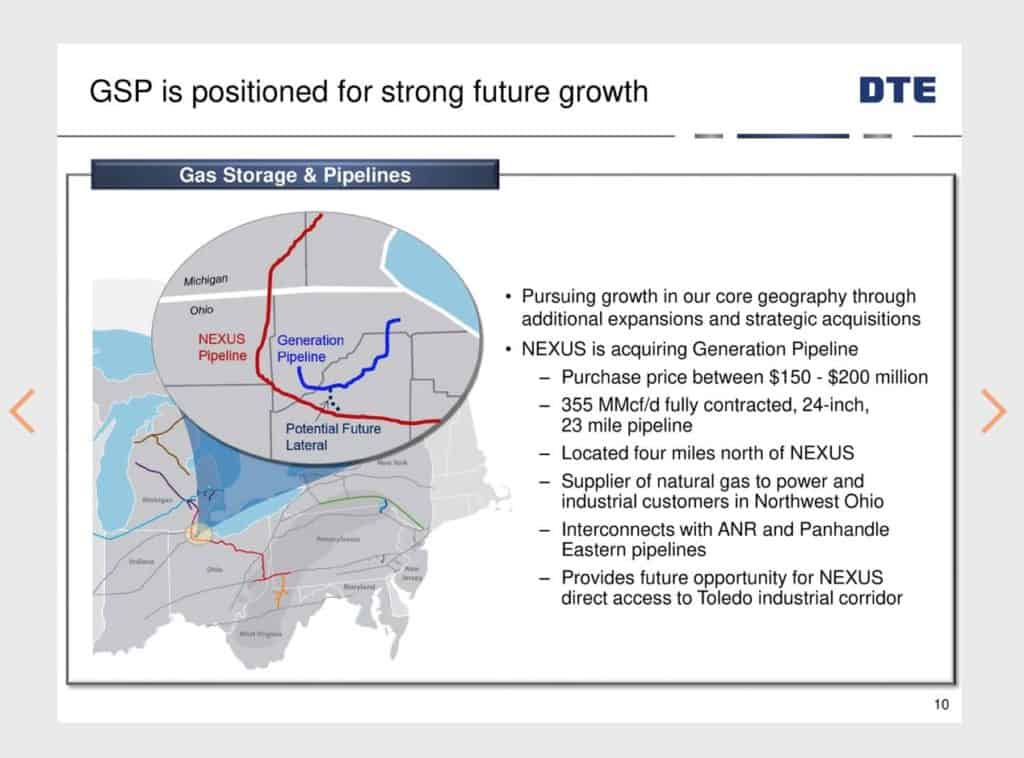

The difference between Consumers, which has sworn off of gas and is investing heavily in renewable energy, and DTE Energy, which seems poised to continue asking for approval to charge its ratepayers to construct new gas plants, may derive from the companies’ increasingly divergent business segments outside of their regulated electric utilities. Unlike Consumers Energy, DTE Energy is heavily involved in the natural gas pipelines and storage business. It has invested billions of dollars in infrastructure, particularly in the Marcellus and Utica shale region, to make sure fracked natural gas can be delivered through its pipeline assets and to have both DTE Gas and DTE Electric ratepayers serve as a captive market for that fuel.

“With our current slate of assets tied to the Marcellus and the Utica, we kind of see a world-class resource connected to very proximal markets on the East Coast as well as Midwest,” President and COO Jerry Norcia said on last year’s earnings call. “You are going to see a fundamental shift from coal use to natural gas use over time, as these plants age out, as you can see from our sort of plants for

The utility’s joint ownership of the NEXUS Pipeline with Enbridge began commercial operations late last year, and CEO Gerry Anderson recently announced plans to connect the pipeline with another pipeline the company is acquiring – the Generation Pipeline.

The corporation’s investment in its gas pipelines business segment has helped leadership keep shareholders happy with the increase in profits. Over the past two years, the pipelines and storage segment has made up nearly a quarter of the corporation’s total profits – up from 8 percent in 2010.

DTE executives plan to spend between $4 and $5 billion over the 2019-2023 period on natural gas gathering and pipeline investment expansion.

With billions of dollars already invested and billions more likely to come, utility executives will continue to need buyers of natural gas, and none are more reliable than the customers of its own regulated monopoly.

Norcia recently told state lawmakers at a March 12 Senate Energy and Technology Committee meeting that the gas power plant DTE is constructing, Blue Water Energy Center, “helped anchor” the NEXUS pipeline. NEXUS is projected to supply fuel to the company’s new gas power plant, paid for by DTE Electric ratepayers.

Future gas plants will require more contracts with DTE’s gas and pipelines business segment or the plants might serve as “anchors” for even more pipelines to be constructed and operated by the corporation.

Photo source: Ken Lund. https://bit.ly/2CQ5cRw