Duke Energy

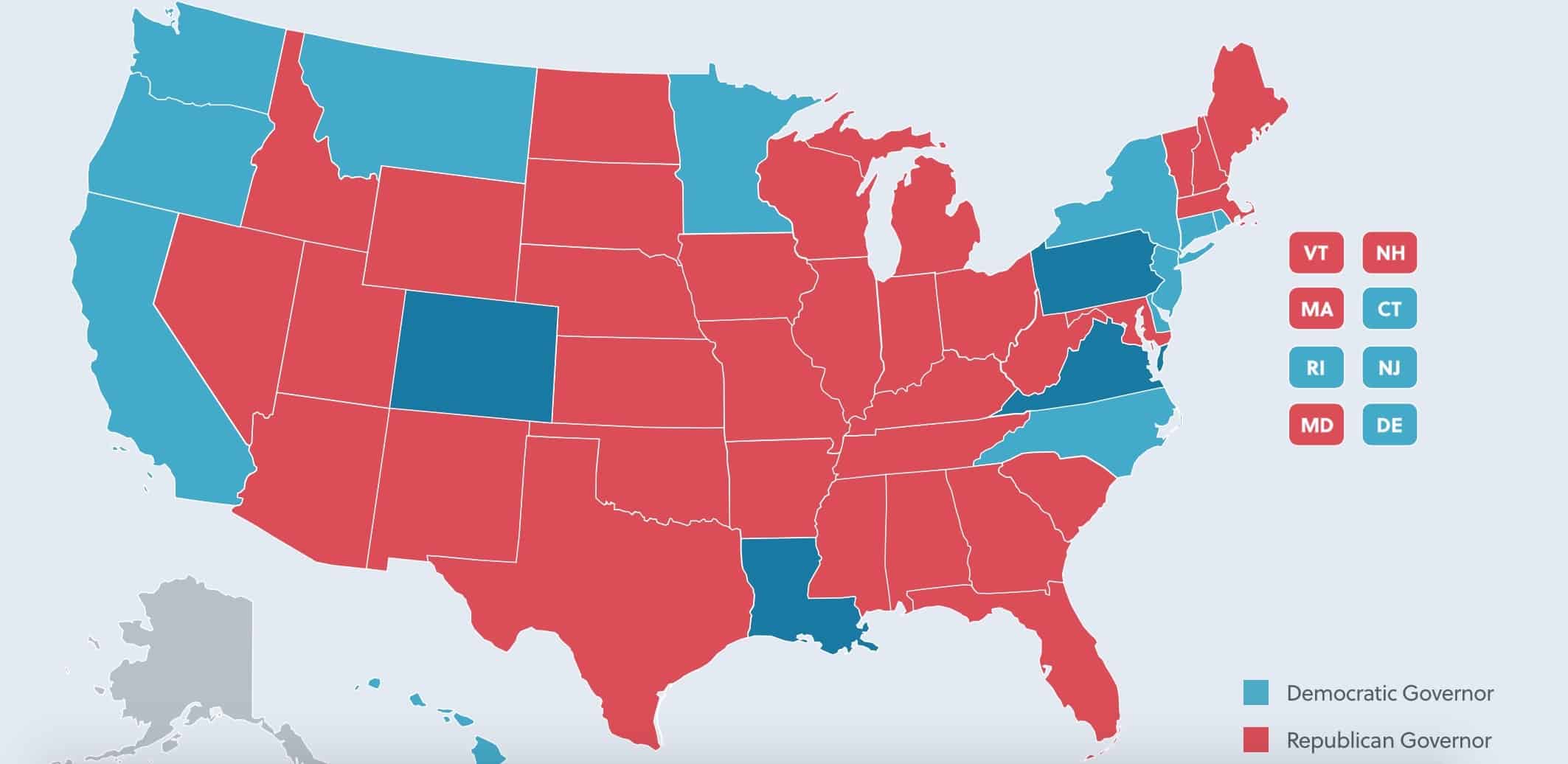

Duke Energy is one of the largest utility holding companies in the United States, providing electricity to 7.7 million retail customers in six states: North Carolina, South Carolina, Indiana, Ohio, Kentucky, and Florida.

Duke’s natural gas utility companies also distribute gas in the Carolinas, Kentucky, Ohio, and Tennessee through its regulated utility subsidiaries Piedmont Natural Gas and Duke Energy Ohio.

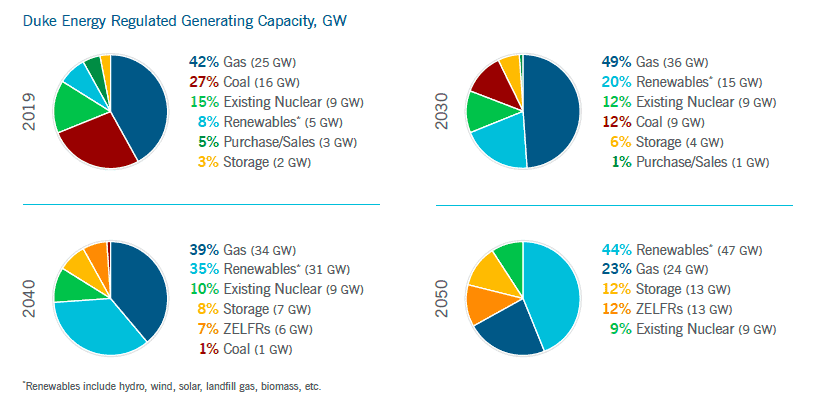

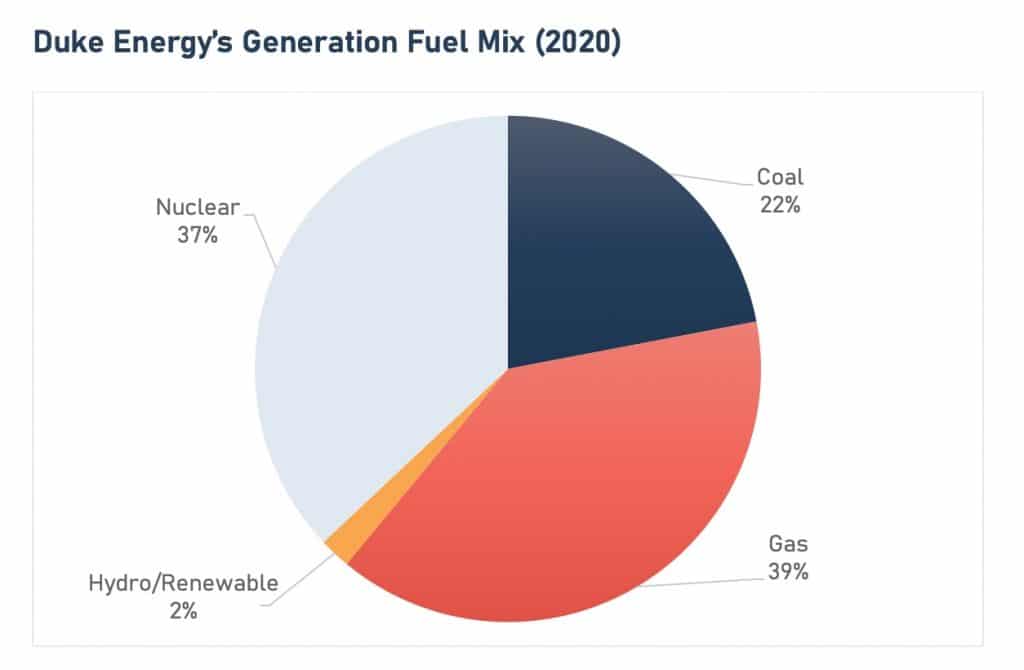

Coal and gas combined for 61% of total generation for all of Duke Energy’s subsidiaries in 2020.

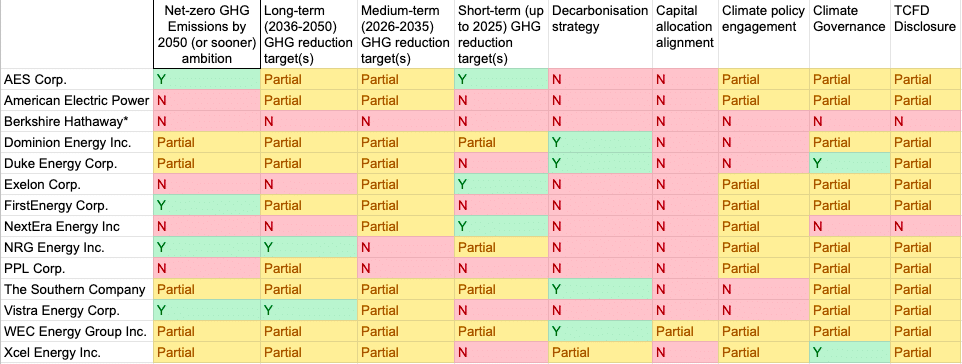

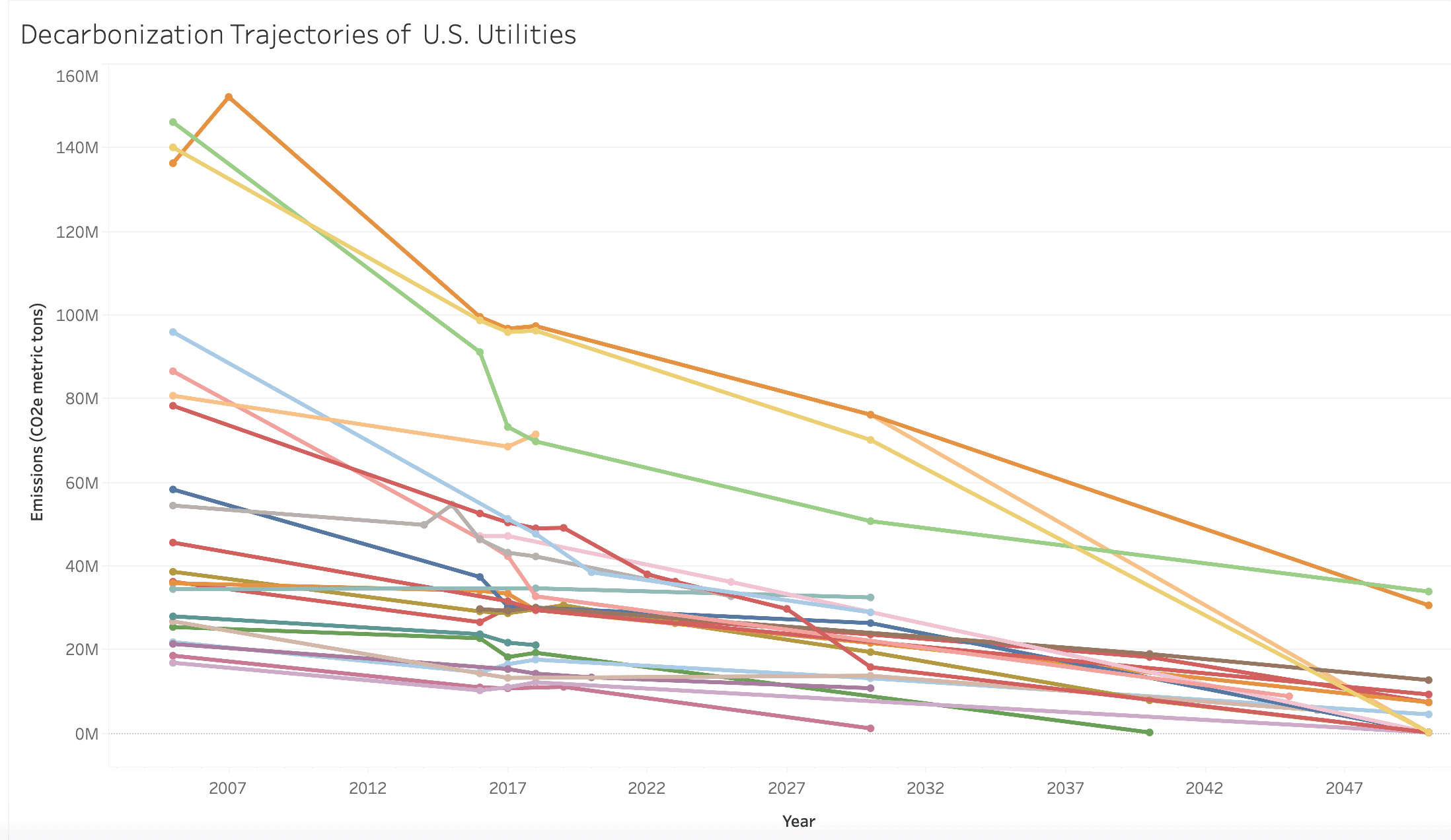

While Duke Energy has a net zero carbon emissions by 2050 goal, research conducted by the Sierra Club shows that its subsidiaries are not moving fast enough toward clean energy in the time frame needed to avoid the worst impacts of the climate crisis. Sierra Club assigned a score to every utility in January 2021 based on its plans to retire coal, construct new gas plants, and build new clean energy. All of the Duke Energy subsidiaries received an ‘F’.

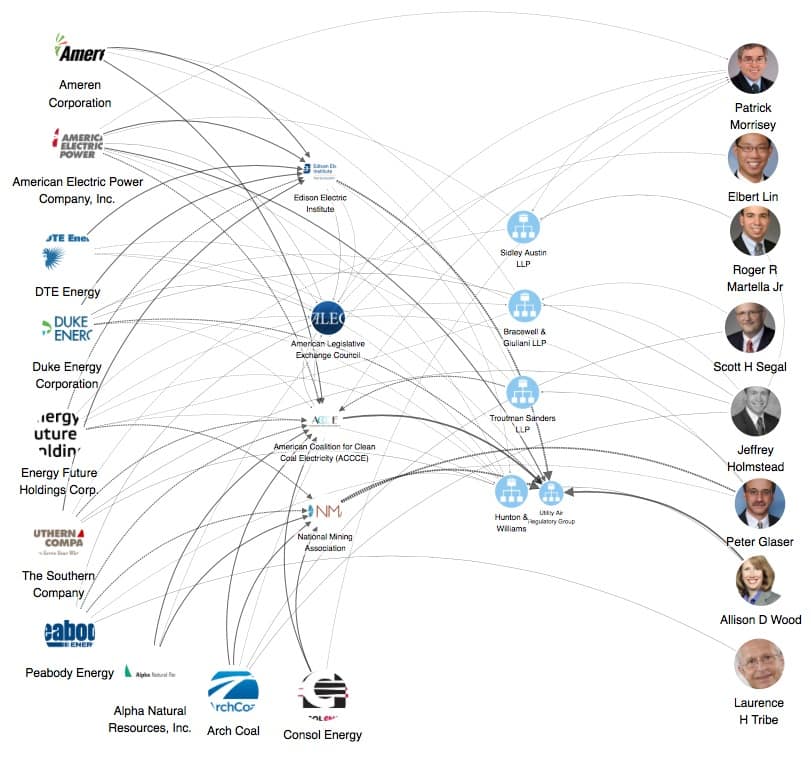

Duke Energy’s climate policy engagement was also assessed in January 2021 by the Climate Action 100+, which is a collection of 570 investors responsible for over $54 trillion in assets under management coordinated by a group of five investor networks. Climate Action 100+ believes that an important component of company commitments on climate change is the formation of comprehensive business strategies that fully align with the goals of the Paris Agreement and reaching net-zero emissions by 2050 or sooner.

Climate Action 100+ found that Duke Energy failed to:

- Have a specific commitment/position statement to conduct all of its lobbying in line with the goals of the Paris Agreement.

- List its climate-related lobbying activities, e.g., meetings, policy submissions, etc.

- Disclose its trade association memberships.

- Have a specific commitment to ensure that the trade associations the company is a member of lobby in line with the goals of the Paris Agreement.

- Conduct and publish a review of its trade associations’ climate positions/alignment with the Paris Agreement.

Duke released a report in March 2021 that disclosed more information about their advocacy with regard to climate policy. However, Duke’s report is limited to a review of its trade association activities for the groups that received over $50,000 in dues from the utility. The company failed to disclose its direct lobbying activities or, as initially requested, the political activities of its Duke Energy Foundation. Duke’s Trade Associations Climate Review also positioned the company as aligned with the climate policies of the Business Roundtable (BRT), U.S. Chamber of Commerce, Interstate Natural Gas Association of America (INGAA) – all groups that have lobbied for policies supportive of the fossil fuel industry.