FERC Account 426.4

Electric utilities are required to file a financial and operating report every year to the Federal Energy Regulatory Commission (FERC). The form is referred to as Form 1, and all of the filings can be found on the FERC website or in FERC’s eLibrary. FERC also requires that utilities within its jurisdiction categorize their accounting in accordance with the Commission’s Uniform System of Accounts, which provides basic account descriptions and definitions that are useful in understanding the information reported in Form 1. A standardized accounting system allows for an effective examination of revenues and expenses by state and federal commission staff when utilities file rate cases or when they are audited.

Certain costs that are itemized in account codes are generally allowed by regulators to be recovered by the utility through its rates, and there are expenses which are not. One code that should not be recovered through rates is 426.4, titled “Expenditures for certain civic, political and related activities.”

The government defines account 426.4 as:

(a) This account must include expenditures for the purpose of influencing public opinion with respect to the election or appointment of public officials, referenda, legislation, or ordinances (either with respect to the possible adoption of new referenda, legislation or ordinances or repeal or modification of existing referenda, legislation or ordinances) or approval, modification, or revocation of franchises; or for the purpose of influencing the decisions of public officials.

(b) This account must not include expenditures that are directly related to appearances before regulatory or other governmental bodies in connection with an associate utility company’s existing or proposed operations.

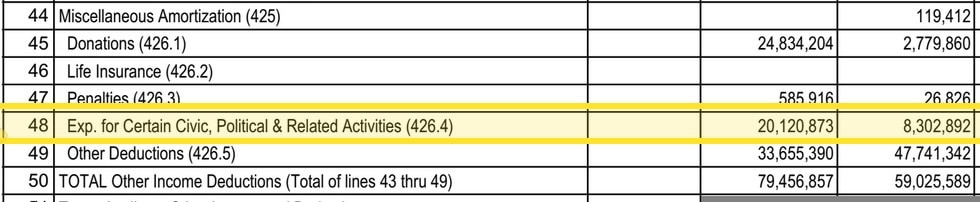

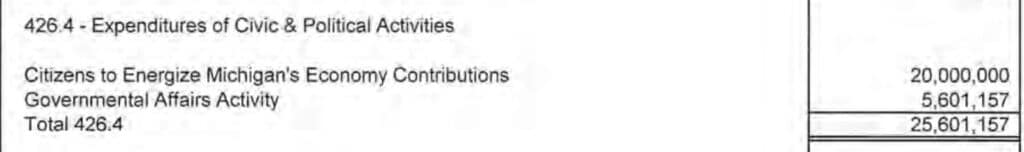

An example of what this looks like in Form 1 is below:

Michigan-based Consumers Energy reported $20.1 million in expenditures for “certain civic, political and related activities” in 2016.

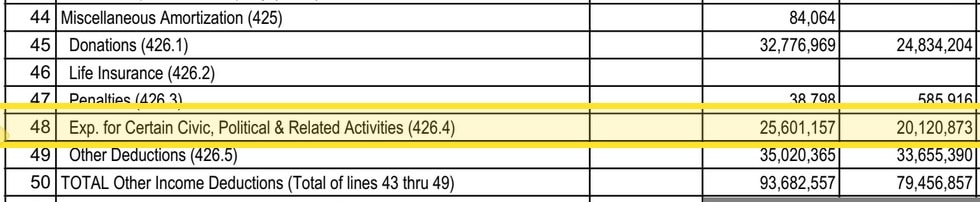

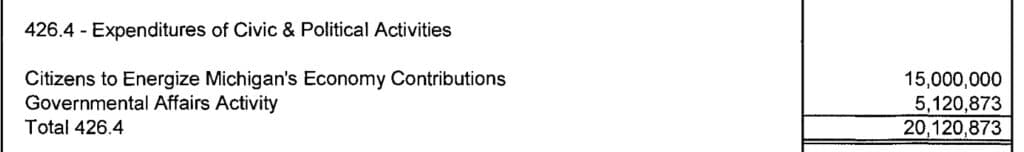

The following year, Consumers Energy reported $25.6 million in account 426.4:

Consumers Energy provided additional details about this account in its 2016 and 2017 annual report to the Michigan Public Service Commission. The reports revealed that Consumers Energy funneled a total of $35 million in 2016 and 2017 to an entity called Citizens For Energizing Michigan’s Economy (CEME), which is a 501(c)4 organization and spends the Consumers Energy money to influence certain primary and general election races in Michigan. Consumers Energy has sent at least $43 million to CEME since 2014.

The utility has since stopped detailing its 426.4 expenditures in its filings with the Michigan Public Service Commission.

Utility staff have sometimes misallocated costs by placing political expenditures in different account codes that would generally be recoverable by ratepayers or in codes likely not thoroughly examined by commission staff. State and federal regulators, commission staff, and consumer advocates have occasionally caught these errors, though it’s impossible to know how often utilities have escaped scrutiny.

Duke Energy allocated its American Legislative Exchange Council membership dues in an account that is typically covered by the ratepayers – 921 (Office Supplies and Expenses). ALEC connects lawmakers with corporate lobbyists to produce model bills that are then introduced in legislatures across the country. Bills that have come out of ALEC over the past few years have advanced the corporate members’ interests at the expense of both the environment and the public’s health.

In the Duke Energy 2013 rate case in North Carolina, an intervenor caught the ALEC misallocation (along with many other errors) and sought to correct the account and have the ALEC expenses charged to 426.4. Duke Energy later testified:

“It is of course unfortunate that errors can creep into a rate filing, but the filing is performed by human beings and no human being is perfect. And, in this case, the checks and balances embedded in the system — specifically the Public Staff’s audit — worked to eliminate these mistakes. No customer will pay one penny in connection with any of these mistakes, as the charges are not being sought in this case.”

At the federal level, FERC’s Division of Audits and Accounting (DAA) in the Office of Enforcement has the power to perform audits, access company books and records, and require companies to retain records. The DAA releases an annual audit report that details audit results, recommendations, and the entity’s commitment to improving compliance. In 2020, for instance, the DAA found that Michigan Electric Transmission Company (a subsidiary of ITC Holdings) “recorded lobbying costs associated with pensions in Account 926.” The 926 account, reserved for costs associated with employee benefits and pensions, is included in METC’s FERC-approved formula rate (426.4 is not part of the rate), and then gets collected from customers through electric bills. As a result, METC “overstated its wholesale transmission revenue requirement used to bill transmission customers by approximately $57,673 from 2015 through 2018.”

The DAA also found in 2020 that ALLETE allocated lobbying expenses to account 921 that resulted in a higher transmission formula rate. ALLETE agreed with the DAA’s recommendation of issuing refunds. In January 2021, the DAA discovered that UGI Utilities Inc. improperly recorded a portion of the utility’s membership dues to the Pennsylvania Chamber of Business and Industry in 930.2, which is the account code associated with “industry association dues for company membership”. The DAA said it should be recorded in 426.4

Utilities are also not fully reporting their civic, political and related activities expenditures in FERC Form 1 filings. This could be because they have allocated those expenditures in a different account and not been caught in audits, or because a parent company of the electric utility that is not filing the Form 1 paid the costs. For instance, DTE Energy has said that its FERC disclosures do not include amounts given to 501(c)4 organizations.

Utilities are also not fully reporting contributions that should be classified in another account code, 426.1, for “Donations.” Account 426.1 is where FERC requires that utilities disclose the total amount of payments or donations for charitable, social or community welfare purposes. According to Arizona Public Service filings to the Arizona Corporation Commission (ACC) in response to a subpoena, the utility spent $25,961,951 in grants to charitable organizations from 2013 – 2017. APS reported a total of $11,727,078 in donations from 2013-2017 in 426.1 on its Form 1 filing to FERC.

And an EPI analysis of FirstEnergy subsidiaries’ FERC filings reveals that expenses submitted in 426.4 do not add up to anywhere near the $60 million that FirstEnergy Service Company paid in 2019 to two 501(c)(4) organizations – Generation Now Inc. and Partners for Progress Inc. – now involved in a federal racketeering case in Ohio.

Utilities might also object to certain definitions of “lobbying.” The California Public Utilities Commission’s Public Advocate’s Office and Sierra Club have recently revealed that SoCalGas has used ratepayer funds to oppose higher energy efficiency standards through actions that may not fall under the IRS definition of lobbying.

In addition to FERC, which can conduct audits, state regulators also have the ability to use Form 1s and other regulatory authority to check to see if utilities are misallocating political spending in ways that leave ratepayers at risk of paying for political behavior. The ACC has shed light on utility political spending in recent years. In 2019, the ACC asked Arizona Public Service and its parent company, Pinnacle West, questions about their political spending (Docket: E-01345A-19-0043). Here are several of the questions to which APS responded in the docket, as reported by EPI here:

- “Please provide the FERC Form 1 filed by APS for each of the following years: 2013, 2014, 2015, 2016, 2017 and 2018.”

- “Please provide a list of all expenditures to 501(c)(3) and 501(c)(4) organizations made by APS in each calendar year. Please indicate to whom the expenditure was made, the amount of the expenditure, and what the expenditure was for.”

- Please provide a list of all expenditures to 501(c)(3) and 501(c)(4) organizations made by Pinnacle West in 2013, 2014, 2015, 2016, 2017,and 2018. “Please indicate to whom the expenditure was made, the amount of the expenditure, and what the expenditure was for.”

- “Please provide the specific details about the names of charities, whether the donor was APS or the APS Foundation, the dollar amounts given and the donation dates. If Pinnacle West donates to charities, please provide the information on its giving as well.”

At least $1.5 billion was spent by utilities for “certain civic, political and related activities” between 2015 and 2020. This data does not encompass all of the industry’s political spending to influence the public and decision makers. Utilities might be reporting 501(c)(4) contributions elsewhere as DTE Energy appears to do, making errors in their account codes, having holding companies funnel the money, or following a narrow definition of lobbying. This database also does not include gas utilities. A utility’s political action committee contributions will also not appear in 426.4, since utility PACs typically consist of employee contributions, as opposed to dollars from the company’s treasury.

Below is a table of every electric utility company’s 426.4 spending between 2015 and 2020.

A table for every utility subsidiary filing between 2015 and 2020 is available here.

The data is from FERC Form 1 filings that was produced by Catalyst Cooperative as part of the Public Utility Data Liberation Project.