FERC Account 930.2

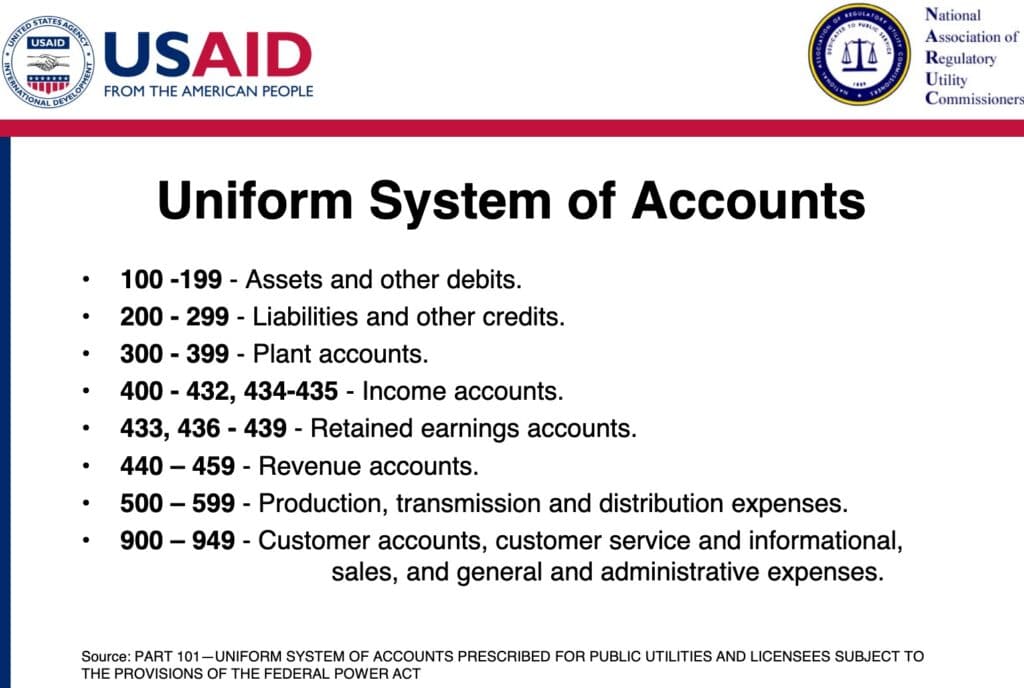

Electric utilities are required to file a financial and operating report every year to the Federal Energy Regulatory Commission (FERC). The form is referred to as Form 1, and all of the filings can be found on the FERC website or in FERC’s eLibrary. FERC also requires that utilities within its jurisdiction categorize their accounting in accordance with the Commission’s Uniform System of Accounts, which provides basic account descriptions and definitions that are useful in understanding the information reported in Form 1. A standardized accounting system allows for an effective examination of revenues and expenses by state and federal commission staff when utilities file rate cases or when they are audited.

Certain costs that are itemized in codes are generally allowed by regulators to be recovered by the utility through its rates, and there are expenses which are not. Within Form 1, there is an account number classified as 930.2 and is titled, “Miscellaneous General Expenses.” Utilities typically request permission to recover expenditures they have placed in the 930.2 account in rate case proceedings.

The definition for this code is: “the cost of labor and expenses incurred in connection with the general management of the utility not provided for elsewhere.” Utilities, per the Uniform System of Accounts definition, also include in this account costs associated with “industry association dues for company membership.” The American Gas Association, Edison Electric Institute, and Nuclear Energy Institute are frequent industry associations that fall into this category. Other trade groups might include the Electric Power Research Institute, or the American Public Gas Association and National Rural Electric Cooperative Association – depending on the utility (investor-owned, municipally owned, or cooperative utilities owned by their members).

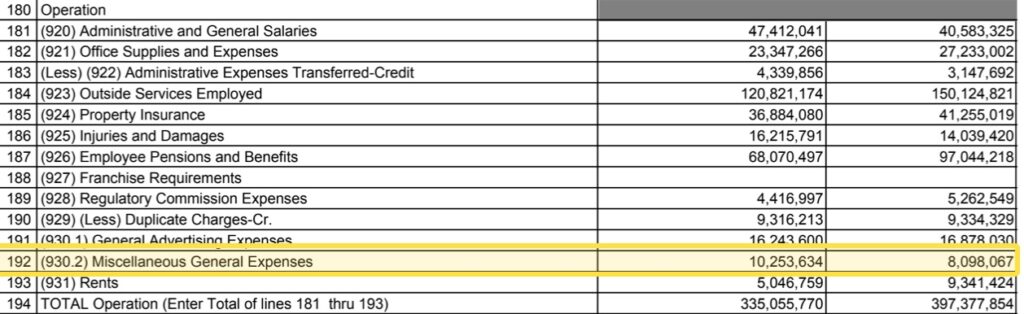

An example of what the FERC form looks like is below:

Georgia Power reported $10.2 million in account 930.2 in 2018, and $8 million in 2017.

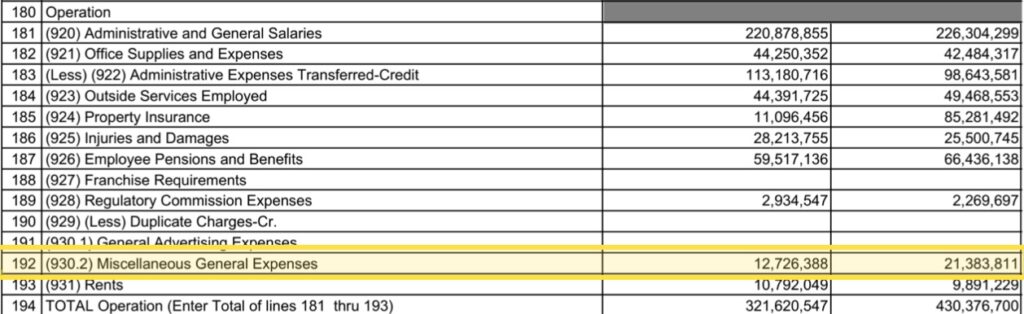

Florida Power & Light reported $12.7 million in 2018, and $21.3 million in 2017.

Utilities use these trade associations to influence state and federal regulators and lawmakers. EPI published a report that details how utility companies embed their membership dues to EEI and other political trade groups in their rates. This widespread practice results in ratepayers subsidizing political activities with which they may not agree and from which they may not benefit.

The Los Angeles Times reported last year how SoCalGas has charged ratepayers for some of its contributions to the American Public Gas Association (APGA) and other gas industry advocacy groups, according to data shared with the newspaper. APGA has led a campaign to “highlight the virtues of natural gas.” Daniel Buch, a supervisor at the PUC’s Public Advocates Office, said SoCalGas’ utilization of APGA to run a campaign is a “systematic and intentional response to the threat” posed by California’s efforts to reduce fossil gas and the associated methane emissions. “Using ratepayer funds to undermine the state’s interests and goals is inappropriate,” said Buch.

In a few recent rate cases, consumer and environmental advocates or public service commission staff have filed data requests to examine account 930.2. Intervenors also have requested additional information in their efforts to make sure utility spending in this account actually benefits the ratepayer.

The Florida Public Service Commission requires utilities to provide the schedule of industry association dues included in the cost of service by organization for the test year and the most recent historical year.

The Office of the Attorney General in Kentucky has asked LG&E and KU not only to provide industry association dues, but also copies of invoices from the organizations, as well as to confirm the amount of money allocated to account 930.2, and the amount allocated to 426.4, that is used for lobbying purposes. The Kentucky utilities have looked to recover dues paid to EEI, AGA, Utility Air Regulatory Group, Utility Solid Waste Activities Group, and the American Coalition for Clean Coal Electricity, along with many other organizations.

The New York Department of Public Service staff has asked for descriptive information relating to the purpose of the organizations and the organizations’ financial statements, annual budgets, and activities.

Utilities, however, rarely provide information that demonstrate that the costs associated with membership dues are limited to activities that benefit ratepayers and therefore are just and reasonable.

In direct testimony filed in November 2018 in a DTE Electric rate case, Karl Rábago on behalf of the Natural Resources Defense Council, Michigan Environmental Council, and the Sierra Club, argued that the PSC should deny recovery of the expenses because DTE did not provide information to support the reasonableness of cost recovery or to “ensure the accuracy of the assertions by EEI as to the extent to which dues are used to support lobbying and advocacy positions.” In the Proposal for Decision, the Administrative Law Judge (ALJ) agreed with Rabago’s argument and highlighted how there had been no recent audits of EEI’s spending and “state utility commissions are beginning to address the concerns about lack of transparency in EEI expenditures.” The Michigan PSC ignored the ALJ’s recommendation and allowed DTE to recover the $1.2 million in EEI dues from its customers.

The following year, the Association of Businesses Advocating Tariff Equity (ABATE), which is a collection of large users of electricity in Michigan whose members include General Motors and Enbridge, recommended that $15.5 million in membership dues and fees be removed from DTE’s annual O&M expenses. ABATE said DTE has recorded nearly $80 million over the last six years to support its membership in utility industry associations, which includes EEI. ABATE detailed how annual invoices from EEI, for example, have increased from $1,281,836 in 2015 to $1,404,805 in 2019. ABATE further said groups such as EEI, which receive a majority of their revenue from utility membership dues, are political in nature and promote policies that are not always in the best interest of ratepayers. (This contention forced DTE to discover it made an error in including $281,175 in base rates for membership fees relating to an organization that should have been fully excluded.) The ALJ in this rate case disagreed with ABATE’s arguments:

“[C]ost of these memberships has been included in rates in prior cases and there is no evidence on the record to show that these organizations engage in lobbying or political activity the costs of which are not otherwise excluded as required by accounting rules, or that they engage in any form of speech that would constitute compelled speech by customers.”

In 2019, the California Public Utilities Commission disallowed Southern California Edison from recovering its EEI dues in rates. The CPUC said, “We find SCE has not met its burden to establish any portion of the Edison Electric Institute dues are recoverable from ratepayers.”

The administrative law judges (ALJs) in the the SCE rate case agreed with The Utility Reform Network (TURN) and recommended that the California Public Utility Commission reject the recovery of $1.552 million in EEI dues (along with contributions to the California Taxpayer Association, the Business Roundtable, California Small Business Association, and California Small Business Roundtable).

The ALJs specifically said that providing the EEI invoice is “insufficient evidence to establish the portion of the invoice which should be recovered from ratepayers” and that “SCE has not met its burden to establish any portion of the EEI dues are recoverable from ratepayers.”

Below is a table of every utility holding company’s 930.2 spending between 2015 and 2019. (A table for every utility subsidiary filing between 2015 and 2019 is available here.)

Since account 930.2 is a broad expense category, intervenors in rate cases can ask for trade association invoices, other O&M accounts in addition to 930.2 that include membership expenses, and:

- Documents in the Company’s possession that show how the trade association spends the dues it collects, including the percentage that goes to the following categories previously provided and audited by the National Association of Regulatory Utility Commissioners: legislative advocacy; legislative policy research; regulatory advocacy; regulatory policy research; advertising; marketing; utility operations and engineering; finance, legal, planning and customer service, and public relations.

- A detailed description of the services provided by the trade association to the Company during the years in question. They can ask, of these services or benefits, which accrue to ratepayers, and how.

- Copies of all work products which the trade association provided to the Company during the years in question, including (but not limited to): presentations, webinar recordings, briefing books, meeting minutes, policy memos, white papers, etc.

The data is from FERC Form 1 filings that was produced by Catalyst Cooperative as part of the Public Utility Data Liberation Project.