List of deceptive RNG and hydrogen projects proposed by utilities

Both gas and electric utilities are using the promise of green hydrogen and RNG as a justification to build gas plants and pipelines that may never use those technologies at all, or only up to a certain threshold.

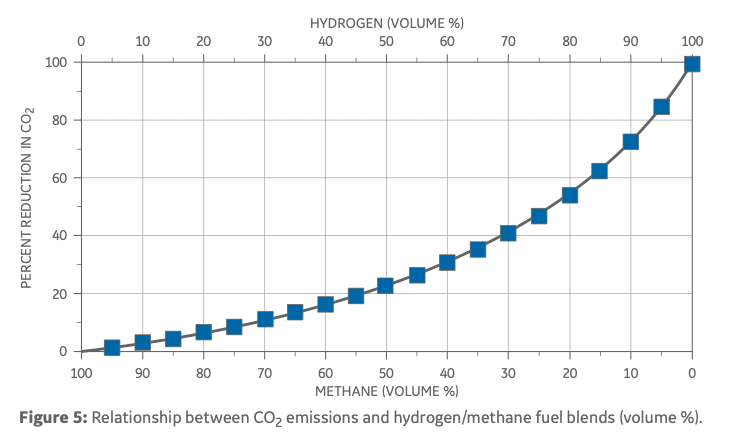

Electric utilities typically suggest that gas-burning power plants will only accept a blend of up to 30% hydrogen and 70% fossil gas. Even that blend of hydrogen reduces carbon by less than it seems. A 30% hydrogen blend reduces the carbon emissions of a gas-fired power plant (ignoring upstream methane leakage rates) by only 12%, not 30%, according to research from GE, which sells turbines for gas-hydrogen blending to utilities.

- Basin Electric, Allete, and Dairyland Power are building the Nemadji Trail Energy Center, a proposed 600 MW gas plant in Superior, Wisconsin. Basin Electric has promoted the idea that the plant is “fuel flexible” and is designed to be technology-ready for 30% hydrogen refuel.

- Xcel Energy bowed to criticism over its plans to replace its Sherco coal plant with an $800 million natural gas plant, opting instead to build two smaller natural gas peaker plants elsewhere, reportedly at half the cost. In a regulatory filing, Xcel claims both new peakers would operate on natural gas in the near term and “could be converted to operate on 100 percent hydrogen in the future.” Xcel offers no details on the technology it would use to burn 100% hydrogen.

- Salt River Project plans to expand the Coolidge Generating Station with 16 new gas turbines (820 MW, at a cost of $830 million – $953 million). The presentation by SRP management to the SRP board included a note that the gas turbines are “Hydrogen capable” (page 168). During the September 16 board meeting, SRP staff said the turbines could burn a blend of up to 30% hydrogen.

- El Paso Electric recently partnered with Mitsubishi Power Americas to develop a plan to use hydrogen in one of the units at the Newman Power Station. The unit will convert from all fossil gas generation to a blend of up to 30% hydrogen, and eventually to all hydrogen, according to the companies.

- Southern Company’s Alabama Power claims its Unit 8 at Plant Barry, which is expected to come online in 2023, is a “good candidate” for future research on hydrogen.

- DTE Energy claims its new gas power plant, Blue Water Energy Center, is a “critical component of reaching net zero” by 2050 since this plant could use carbon capture and hydrogen fuel.

- American Electric Power claims its gas peaker plants could be candidates for future fueling with green hydrogen. AEP’s Indiana Michigan Power recently detailed plans of building peaker units in 2028, 2034, and 2037.

- Bakken Energy and Mitsubishi Power Americas are seeking to purchase a Basin Electric coal gasification plant to convert it to a blue hydrogen facility. A blue hydrogen project burns hydrogen that is produced from gas power plants equipped with carbon capture. However, blue hydrogen has its own pitfalls and is not compatible with a decarbonized economy since emissions will continue at almost every state of the blue hydrogen process – extraction, transportation, processing, transmission, and storage.

- Newpoint Gas LLC and Brooks Energy Company are seeking to purchase the Escalante coal plant (closed by Tri-State in 2020) to convert it to a blue hydrogen facility.

- The Clean Energy Group’s repository includes additional irresponsible hydrogen projects announced by Dominion, Duke Energy, Entergy, Florida Power & Light, and NRG Energy.