The Petra Nova carbon capture project has stopped operating because low oil prices have made it uneconomic to sell carbon dioxide to boost oil drilling operations. As the only coal carbon capture project in the U.S. and the largest post-combustion carbon capture project in the world, the failure of the Petra Nova project represents a major setback for proponents of coal carbon capture projects.

While supporters of coal carbon capture proposals have often pointed to the Petra Nova project as a success story, a technical report submitted by Petra Nova to the Department of Energy shows that the project actually experienced so many outages that it wasn’t operating for one of out every three days over the last three years. Filings with the Securities and Exchange Commission also reveal how the carbon capture project led to unexpected financial losses for NRG.

According to a representative for NRG, the company that operates the W.A. Parish Generating Station from which Petra Nova captured emissions, the carbon capture project has not operated since May 1, 2020. E&E News first reported that the carbon capture project had been placed in a “mothball status.”

The NRG representative also confirmed that the coal unit is continuing to operate without capturing its emissions. So carbon emissions from the power plant have increased – although only slightly, since the project captured just 7% of the power plant’s emissions when it was operating. Regardless of what happens with the Petra Nova carbon capture project in the future, air pollution from the W.A. Parish Generating Station that impacts communities in Houston and the region make it the deadliest coal plant in Texas.

$1 billion project captured 7% of power plant’s carbon emissions

Petra Nova is the only coal carbon capture project in the U.S., and was built at a cost of $1 billion, including $195 million of public funding through the U.S. Department of Energy. The project is a joint venture between NRG and Jippon NX, a global oil and gas company based in Japan. It captured carbon dioxide from one of the four coal units at NRG’s W.A. Parish Generating Station near Houston, Texas, and delivered it through an 81-mile pipeline to the West Ranch oil field where it was used to boost oil extraction, a process known as enhanced oil recovery. Hilcorp Energy operates that oil field, but NRG and Jippon NX also gained a stake in it as part of the Petra Nova project.

The carbon capture infrastructure was powered by a separate gas generator, which generates its own emissions that are not captured. That offsets some of the emissions captured at the coal unit, even before accounting for the emissions from burning the extracted oil, as Rice University professor Daniel Cohan noted:

The natural gas needed to run #PetraNova carbon capture process offset around a quarter of the C captured, before accounting for methane leaks in producing and transporting the NG, energy to pipe the CO2, or the CO2 from burning the recovered oil.https://t.co/A2s9caad3f pic.twitter.com/ecRB0ifSo4

— Daniel Cohan (@cohan_ds) July 29, 2020

Despite claims that Petra Nova reduced emissions “by 90 percent,” the project actually only captured emissions from a 240 megawatt portion of the 654 megawatt coal unit, amounting to an emissions reduction of about 33% from that one coal unit. No emissions were captured at the other three coal units or the gas units at the W.A. Parish Generating Station.

Some articles have provided the context that the project only captured about 10% of the power plant’s carbon dioxide emissions, but even that number turns out to have been too high: EPI reviewed emissions data from the Environmental Protection Agency and a report submitted to the Department of Energy, and found that the carbon capture project actually captured just 7% of the power plant’s total carbon dioxide emissions.

According to a March 2020 Final Scientific/Technical Report submitted to the Department of Energy (DOE), Petra Nova captured 1,071,016 metric tons of carbon dioxide in 2017 – 7% of the 15,294,962 million metric tons emitted by the W.A. Parish Generating Station, according to EPA data. In 2018, the project captured 1,017,907 metric tons, 6.9% of the plant’s total 14,620,770 metric tons. Petra Nova captured 1,387,243 metric tons of carbon dioxide in 2019, but EPA emissions data for the power plant are not yet available for 2019.

Petra Nova suffered outages one out of every three days

After the high profile and expensive failure of Southern Company’s Kemper carbon capture project, advocates of coal carbon capture proposals have often pointed to NRG’s Petra Nova project as a success story. Power Magazine named Petra Nova “Power Plant of the Year” in 2017, and the Carbon Capture Coalition (formerly known as the National Enhanced Oil Recovery Initiative) said: “Petra Nova successfully entering formal operation in the U.S. marks a crucial further milestone in the ongoing commercialization of carbon capture technology in the power sector.” Department of Energy officials have also repeatedly touted the project, such as to “celebrate the third operating anniversary of Petra Nova” in January 2020.

But the technical report submitted to DOE reveals that the project suffered a variety of problems during the three-year “Demonstration and Monitoring” period of 2017 through 2019. A table in that report shows that the project experienced 367 days of outages over those three years, or one out of every three days. Problems with the carbon capture infrastructure and gas unit that powered it accounted for most of the outages.

The report submitted to DOE also shows that the Petra Nova project received Notices of Violations from the Texas Commission on Environmental Quality and from the Texas Railroad Commission, the latter concerning the carbon dioxide pipeline.

The report also shows that the Petra Nova carbon capture infrastructure and gas unit used 1.49 billion gallons of water over the three year period (not including water consumed by the coal unit). Studies show that operating carbon capture infrastructure significantly increases water consumption if used at coal plants.

Low oil prices disrupted the economics of Petra Nova from the start

NRG has not said when the company might restart the Petra Nova carbon capture project, and a representative said there is not a specific oil price that would trigger that decision. But low oil prices have disrupted the project from the start, well before oil prices fell further this year, and NRG executives have said that the project only makes economic sense with much higher oil prices – perhaps double current oil prices.

A Houston Chronicle article in 2015 noted how low oil prices were disrupting carbon capture projects, and included comments from NRG’s then-CEO David Crane:

NRG Chief Executive David Crane recently acknowledged the idea no longer is a moneymaker when U.S. oil prices are hovering near $45 a barrel.

“It’s the concept of carbon capture to enhance oil recovery as a distinct business opportunity, which made both strategic and economic sense at $75 to $100 a barrel,” he said. “Obviously, it does not currently make economic sense.”

Current NRG CEO Mauricio Gutierrez also acknowledged in 2017 that low oil prices had disrupted the economics of the project:

NRG took the lead on the project in 2014 because “someone needed to prove the concept,” says CEO Mauricio Gutierrez, and because the company expected to make money on it. “We took the risk on behalf of our investors,” he says. The trouble is, the deal (ultimately approved by since-departed David Crane) was built on 2014 expectations that oil prices couldn’t possibly drop below $75 a barrel. Surprise. “At 50-dollar oil it’s very challenging,” says Gutierrez.

Similarly, a report by the Global CCS Institute explained:

Petra Nova project is driven from oil production, with 90% of its revenue stream coming from CO2 sale for EOR. Therefore, oil prices are of utmost importance in this project. According to the project, oil price needs to average $75/bbl over 2018 – 2027 in order for the project to be viable.

NRG had to cover losses at Petra Nova, and determined it has declined in value

Filings with the Securities and Exchange Commission show that losses at the Petra Nova project have impacted NRG. In its 2019 10-K annual report, NRG explained that it “contributed $95 million in cash to Petra Nova” that was used “to prepay a significant portion of the project debt.” NRG also determined that the decline in value of Petra Nova is “other-than-temporary” and so the company “recorded an impairment loss of $101 million.”

During NRG’s second quarter 2019 earnings call, two analysts noted that they were “surprised” that the company might be forced to cover a portion of Petra Nova’s debt. NRG CEO Mauricio Gutierrez explained why NRG would need to pay up to $124 million to cover debt owed by the carbon capture joint venture:

Back in 2014, when we closed the financing for this project, NRG and our 50-50 partner JX Nippon provided a financial guarantee to Petra Nova’s lenders. These guarantees were to remain in place to support a one-time debt service ratio test, which prescribed a prepayment of principal in the event the ratio fell below the threshold. We have been in active negotiations with project lenders, and we now expect to fund the prepayment in the third quarter. Although the final prepayment amount has not yet been determined, our obligation is limited to the guarantee amount.

In a report published this week, the Institute for Energy Economics and Financial Analysis noted that NRG also recorded impairments to the Petra Nova project in 2016 and 2017, and warned potential investors to heed Petra Nova’s failure when considering other coal carbon capture proposals:

The mothballing of Petra Nova highlights the deep financial risks facing other proposed U.S. coal-fired carbon capture projects, including Enchant Energy’s plan for the San Juan Generating Station in New Mexico and Minnkota Power Cooperative’s Tundra Project at the Milton R. Young Station in North Dakota.

Japanese export credit agencies hoped to secure oil fields for Japanese oil companies

In addition to direct funding from the Department of Energy and NRG’s own investments in the project, Petra Nova’s lenders were Japanese export credit agencies, because traditional lenders considered the project too risky, according to a 2015 report by the Paulson Institute. Similar to the Export-Import Bank of the United States and quasi-governmental financial institutions in other countries, export credit agencies finance foreign investments that benefit companies based in their countries.

The Paulson Institute report explains that the involvement of Japanese oil company JX Nippon, which is a 50-50 partner with NRG in the Petra Nova carbon capture project, played a key role in attracting those loans because the Japanese export credit agencies were motivated in part by the prospect of helping secure oil fields for Japanese oil companies and promoting Japanese manufacturing companies:

JX Nippon’s involvement was essential to securing the third and final leg of the financing stool: risk-tolerant debt financing from unconventional lenders.

Due to the unprecedented scale and complex financial structure of the Petra Nova project, “commercial banks saw the project as first-of- a-kind of risk,” explains NRG’s Ragan. “So the financing strategy that we undertook had to be one that didn’t involve traditional commercial lending avenues.”

Instead, JX Nippon’s involvement opened the door to $250 million in loans from two Japanese export credit agencies, the Japan Bank for International Cooperation (JBIC) and Nippon Export and Investment Insurance (NEXI).

A division director for the Oil and Gas Finance Department at one of the Japanese export credit agencies explained that “Expanding this scheme to other regions will support the obtaining of oil field interests by Japanese companies and further the business of Japanese companies.”

NRG’s W.A. Parish Generating Station remains the deadliest coal plant in Texas

Carbon capture policy discussions often focus only on carbon dioxide emissions, ignoring the many other significant impacts of burning coal on the environment and the health of people in nearby communities.

In “Coal-Blooded,” a report by the National Association for the Advancement of Colored People (NAACP), Indigenous Environmental Network, and Little Village Environmental Justice Organization, environmental justice advocates remind policymakers and advocates why that is short-sighted:

An analysis of the physical effects of the coal industry reveal that it is important to consider not only climate change, but also environmental justice, or the disproportionate location and impact of coal-fired power plant activity on low-income communities and people of color.

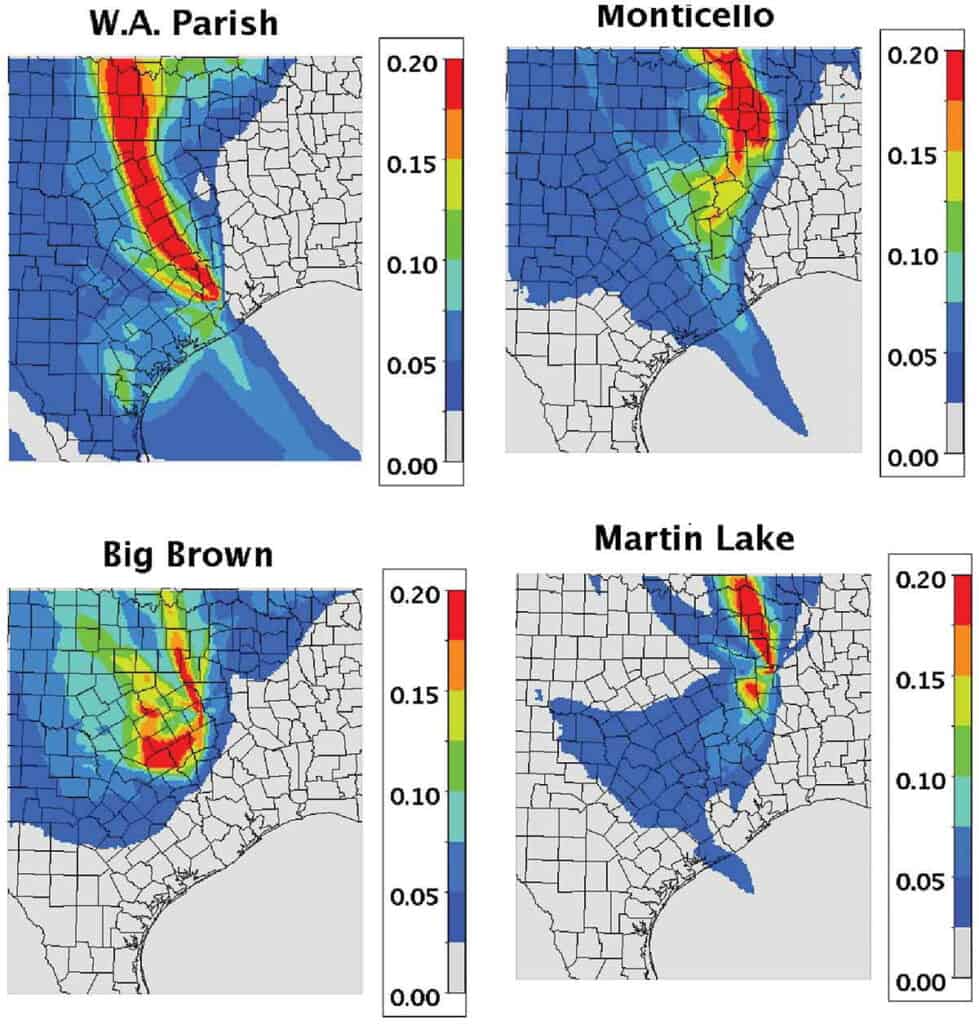

The health impacts of pollution from the W.A Parish Generating Station are a vivid reminder of that call from environmental justice advocates. A study by researchers at Rice University found that air pollution from the W.A. Parish Generating Station caused more deaths than any other coal plant in Texas, in part because air pollutants from the power plant “frequently impact densely populated areas in the nearby Houston suburbs and the Dallas–Fort Worth region.”

Air pollution from coal plants often places a disproportionate burden on communities of color, and that is likely true at the W.A. Parish Generating Station as well. According to the Energy Justice Network’s mapping project, about two-thirds of people living within 25 miles of the massive power plant are Black, Hispanic, Asian, or American Indian, while one-third are White.

[…] of those outages, the system fell 17% short of its capture goal. Ultimately, it only captured about 7% of the plant’s total carbon emissions, according to the Energy and Policy […]

[…] of those outages, the system fell 17% short of its capture goal. Ultimately, it only captured about 7% of the plant’s total carbon emissions, according to the Energy and Policy […]

[…] Först uppgav bolaget att det stängs av ekonomiska skäl, därför att oljepriset är för lågt för att det ska löna sig. Det har senare framkommit att det också fanns stora tekniska problem, och att anläggningen stått stilla en tredjedel av tiden. […]

[…] could be powered by a separate gas unit, as NRG did at the Petra Nova power plant until it suspended operations in […]

[…] used it to boost oil extraction in the nearby West Ranch oil field. Not only has falling oil prices undercut the project’s financial viability, but it has also become clear that the project, which has been plagued by outages, isn’t […]

[…] DER. Many DER technologies are already cost effective, whereas CCUS technology for power plants has yet to be commercially viable anywhere in the United […]

[…] Many DER technologies are already cost effective, whereas CCUS technology for power plants has yet to be commercially viable anywhere in the United […]

[…] the $1 billion Petra Nova plant in Houston, owned by NRG Energy and often touted by carbon capture advocates as an example of a […]

[…] the $1 billion Petra Nova plant in Houston, owned by NRG Energy and often touted by carbon capture advocates as an example of a […]

[…] NRG Energy’s Petra Nova project captures carbon dioxide emissions from a coal-fired power plant in Thompsons, Texas, with the purpose of using the captured cas to extract oil from nearby fields. However, backers of the project were relying on increased oil and gas production to help pay for its $1 billion price tag. But as oil and gas prices dropped with decreasing demand, the project became uneconomical to consistently operate, reports the Energy and Policy Institute. […]

[…] actually made some new ones. The CCS technology at Petra Nova required so much energy that NRG made an entirely separate natural gas power plant—the emissions of which were not offset by the Petra Nova technology—just to power the […]

[…] actually made some new ones. The CCS technology at Petra Nova required so much energy that NRG made an entirely separate natural gas power plant—the emissions of which were not offset by the Petra Nova technology—just to power the […]

[…] actually made some new ones. The CCS technology at Petra Nova required so much energy that NRG made an entirely separate natural gas power plant—the emissions of which were not offset by the Petra Nova technology—just to power the […]

[…] actually made some new ones. The CCS technology at Petra Nova required so much energy that NRG made an entirely separate natural gas power plant—the emissions of which were not offset by the Petra Nova technology—just to power the […]

[…] actually made some new ones. The CCS technology at Petra Nova required so much energy that NRG made an entirely separate natural gas power plant—the emissions of which were not offset by the Petra Nova technology—just to power the […]

[…] actually made some new ones. The CCS technology at Petra Nova required so much energy that NRG made an entirely separate natural gas power plant—the emissions of which were not offset by the Petra Nova technology—just to power the […]

[…] actually made some new ones. The CCS technology at Petra Nova required so much energy that NRG made an entirely separate natural gas power plant—the emissions of which were not offset by the Petra Nova technology—just to power the […]

[…] NRG Energy’s Petra Nova project captures carbon dioxide emissions from a coal-fired power plant in Thompsons, Texas, with the purpose of using the captured cas to extract oil from nearby fields. However, backers of the project were relying on increased oil and gas production to help pay for its $1 billion price tag. But as oil and gas prices dropped with decreasing demand, the project became uneconomical to consistently operate, reports the Energy and Policy Institute. […]

[…] NRG Energy’s Petra Nova project captures carbon dioxide emissions from a coal-fired power plant in Thompsons, Texas, with the purpose of using the captured cas to extract oil from nearby fields. However, backers of the project were relying on increased oil and gas production to help pay for its $1 billion price tag. But as oil and gas prices dropped with decreasing demand, the project became uneconomical to consistently operate, reports the Energy and Policy Institute. […]

[…] NRG Energy’s Petra Nova project captures carbon dioxide emissions from a coal-fired power plant in Thompsons, Texas, with the purpose of using the captured cas to extract oil from nearby fields. However, backers of the project were relying on increased oil and gas production to help pay for its $1 billion price tag. But as oil and gas prices dropped with decreasing demand, the project became uneconomical to consistently operate, reports the Energy and Policy Institute. […]

[…] actually made some new ones. The CCS technology at Petra Nova required so much energy that NRG made an entirely separate natural gas power plant—the emissions of which were not offset by the Petra Nova technology—just to power the […]

[…] catturava solamente il 7% delle emissioni della centrale a carbone di WA Parish, che è considerata la più mortale del Texas a causa delle emissioni nella comunità di Houston e nella regione. Lo stesso rapporto ha segnalato […]

[…] the challenges that await future deployment and commercialization of CCS technology. The facility only captured around 7% of the W.A. Parish Generating Station’s total carbon emissions and, due to technical […]

[…] look at case for level supply carbon elimination expertise. It suffered frequent outages and solely captured 7% of the plant’s emissions, and the carbon dioxide it captured was injected into the bottom so […]

[…] has operated within the U.S. is NRG’s Petra Nova in Texas, and that $1 billion mission has been considered unsuccessful — solely about 7% of carbon emissions have in the end been captured and falling oil costs have […]

[…] operated within the U.S. is NRG’s Petra Nova in Texas, and that $1 billion undertaking has been considered unsuccessful — solely about 7% of carbon emissions have in the end been captured and falling oil costs have […]

[…] Meanwhile, in the new infrastructure bill, $15 billion is also allocated to “carbon capture,” technology for collecting the carbon output of a traditional power plant instead of letting it escape into the atmosphere. Assuming one believes in global warming, it’s not the worst idea, but environmental groups still hate it. Some of their complaints are the usual whining from suicidal activists who will accept nothing less than the total abolition of all fossil fuels. But other objections are more reasonable: Carbon capture doesn’t work that well, it has no economic upside, and the only commercial use of the captured carbon is to improve fossil fuel extraction, negating the ostensible environmental purpose of its existence. America’s only carbon-capture operation at a coal plant, built at the cost of $1 billion, was a financial disaster that shut down last year. […]

[…] Environmental Impact Statements for other major carbon capture projects it funded, including the Petra Nova project, the Kemper project, both FutureGen projects, and several […]

[…] Petra Nova, the only coal carbon capture facility in the US until it was shut down last year after suffering various mechanical issues, used a gas plant to provide steam and power to its carbon capture facility. Emissions from the gas plant were not captured, which canceled out a portion of the emissions captured from the coal unit. Using steam and power from the existing coal plant instead would reduce the amount of electricity generated by the coal plant. […]

[…] also inordinately expensive; projects in Texas, Australia, and elsewhere have been costly failures. Environmental justice movements resoundingly […]

[…] actually made some new ones. The CCS technology at Petra Nova required so much energy that NRG made an entirely separate natural gas power plant—the emissions of which were not offset by the Petra Nova technology—just to power the […]

[…] Petra Nova, which was retrofitted by oil and gas companies specifically for enhanced oil recovery, shut down in 2020 for this very reason. It has yet to start operating again, even as oil prices have shot up above […]

[…] Petra Nova, which was retrofitted by oil and gas companies specifically for enhanced oil recovery, shut down in 2020 for this very reason. It has yet to start operating again, even as oil prices have shot up above […]

[…] Petra Nova, which was retrofitted by oil and gas companies specifically for enhanced oil recovery, shut down in 2020 for this very reason. It has yet to start operating again, even as oil prices have shot up above […]

[…] Petra Nova, which was retrofitted by oil and gas companies specifically for enhanced oil recovery, shut down in 2020 for this very reason. It has yet to start operating again, even as oil prices have shot up above […]

[…] far, CCS hasn’t taken off in the power sector. NRG Energy, for example, mothballed its Petra Nova carbon capture project at a Texas power plant in 2020 after experiencing operating problems and financial losses. It was […]

[…] не прижился в энергетическом секторе. NRG Energy, например, законсервировала свой проект по улавливанию углерода … на электростанции в Техасе в 2020 году после […]

[…] le CSC n’a pas décollé dans le secteur de l’électricité. NRG Energy, par exemple, a mis sous cocon son projet de captage de carbone Petra Nova dans une centrale électrique du Texas en 2020 après avoir connu des problèmes […]

[…] far, CCS hasn’t taken off in the power sector. NRG Energy, for example, mothballed its Petra Nova carbon capture project at a Texas power plant in 2020 after experiencing operating problems and financial losses. It was […]

[…] hat sich CCS im Energiesektor nicht durchgesetzt. NRG Energy zum Beispiel hat sein Kohlendioxid-Abscheidungsprojekt Petra Nova eingemottet in einem Kraftwerk in Texas im Jahr 2020 nach Betriebsproblemen und finanziellen Verlusten. Es war […]

[…] far, CCS hasn’t taken off in the power sector. NRG Energy, for example, mothballed its Petra Nova carbon capture project at a Texas power plant in 2020 after experiencing operating problems and financial losses. It was […]

[…] It’s a largely unproven technology with an empirical record of failure, and relying on it to deal with averting climate catastrophe is reckless. Many climate […]

[…] was struggling with a number of technical failures and further problems. According to press reports, the CCS plant experienced more than 360 downtime days from 2017 to 2019 due to […]

[…] several studies have documented. It’s a largely unproven technology with an empirical record of failure, and relying on it to deal with averting climate catastrophe is reckless. Many climate activists […]