Pollution Payday: Analysis of executive compensation and incentives of the largest U.S. investor-owned utilities

WEC Energy

WEC Energy is a Milwaukee-based utility holding company with electric and natural gas subsidiaries, including the Wisconsin electric and gas utility We Energies, and Peoples Gas, a Chicago gas utility. The corporation’s executive compensation consists of three elements: base salary, annual incentive awards, and a long-term incentive award.

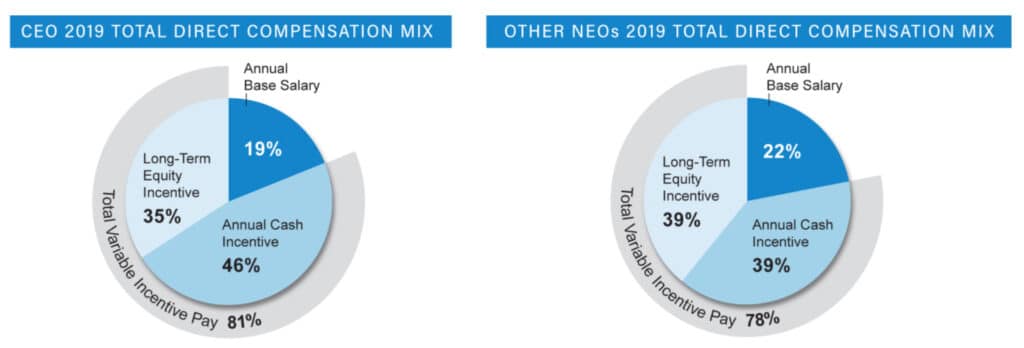

The base salary for WEC Energy executives is a fixed level of annual cash that is comparable to the market median of a comparison group of companies. In 2019, CEO J. Kevin Fletcher’s base salary was $975,939. The base salary, however, is a fraction of Fletcher’s and the other named executive officers’ (NEOs’) total compensation.

The primary driver of compensation, particularly for the CEO, is the annual cash incentive, which is referred to as the Short-Term Performance Plan (STPP). The Board’s Compensation Committee approves a target level each year for each of the NEOs, along with several performance goals. The Committee’s focus is on financial results; thus, it has made earnings per share (EPS) and cash flow the main metrics of the STPP, weighted at 75% and 25%, respectively. In 2019, the Committee set a maximum EPS threshold of $3.52 along with a $2 billion cash flow maximum threshold. WEC Energy’s EPS was $3.58 and its cash flow was $2.3 billion, which satisfied the maximum payout level. Accordingly, the NEOs earned 200% of the target award.

Additionally, the Committee can increase or decrease NEOs’ STPP payout by up to 10%, based on the company’s performance in three additional areas: customer satisfaction (5% weight), safety (2.5% weight), and supplier and workforce diversity (2.5% weight). In 2019, the NEOs received only a 2.5% increase to the compensation awarded under the STPP. As a result, CEO Fletcher received $2,433,884 in total cash compensation under the STPP.

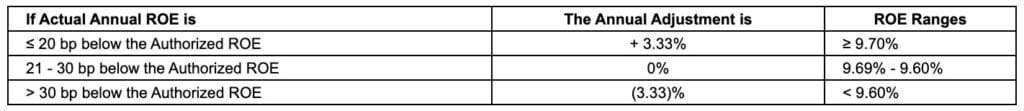

WEC Energy’s long-term incentive compensation plan is primarily focused on rewarding NEOs with stocks based upon the company’s total stockholder return (TSR), or the stock price appreciation plus reinvested dividends. The Compensation Committee amended the plan effective January 1, 2017 to provide for an additional incentive regarding the return on equity (ROE): “Utility net income is an important financial measure as it is an indicator of the return on equity earned by our utilities, and in order to meet our earnings per share targets it is important that our utilities earn at or close to their authorized rate of return.”

The ROE measures how much a utility is allowed to earn in profits on capital expenditures, and is determined by state regulators. Using the ROE as a financial instrument to reward WEC Energy executives incentivizes WEC to increase its capital investments, and to lobby for WEC’s regulators to increase the company’s ROE at the expense of ratepayers.

In 2019, WEC’s utility subsidiaries achieved a weighted average authorized ROE of 10.34%. This resulted in a 3.33% increase in the vesting percentage of the performance units awarded in January 2019, January 2018, and January 2017.

Despite having a net carbon neutral by 2050 goal, WEC Energy’s Compensation Committee does not have an emissions reduction incentive program for executives.

Executives are also provided with certain perquisites, such as financial planning services, annual physical exam costs not covered by insurance, limited spousal travel for business purposes, and dues and fees for club memberships. WEC Energy does not permit personal use of the airplane available to the company, but when traveling for business, spouses are allowed to accompany NEOs as long as the airplane is not fully utilized by company personnel. The company offers to pay club and membership dues because it has “found that the use of these facilities helps foster better customer and community relationships.”

| CEO compensation ranking among utilities studied, 2019 | 17/19 |

| Compensation ratio: CEO to median employee, 2019 | 73:1 |

| Percent change in CEO compensation, 2017-2019 | -32.1% ($4,380,136) |

| Maximum payout of performance-based shares as a percentage of target, 2019 | 200% |

| Is WEC’s executive compensation structure aligned with decarbonization? | No. There is no executive incentive for decarbonization, despite WEC’s 2050 net carbon neutrality goal. |

| Is there evidence from SEC filings that WEC is using misleading financial metrics to determine executive compensation? | No. |

| What key perquisites or benefits do WEC executives receive? | Executives receive complimentary financial planning, annual physical exam costs that are not covered by insurance, limited spousal travel on business trips, dues for club memberships, and non-qualified supplemental retirement benefits. If traveling outside the United States, then executives also receive health and safety services. |