Berkshire Hathaway’s board of directors is opposing a proposal from major shareholder groups that the company publish an annual report disclosing the climate risks it faces, even as the company’s energy subsidiaries remain heavily invested in fossil fuels and have been impacted by extreme weather events.

The company’s resistance to disclosing climate risks to investors comes as financial regulators move to strengthen corporate climate risk disclosure rules, and the Biden administration is expected to announce an executive order on climate related financial risk.

Biden administration and financial regulators pursue new rules on climate finance risks

Last month, Securities and Exchange Commission (SEC) Acting Chair Allison Herren Lee highlighted the need for increased oversight of corporate climate risk disclosures, noting:

Investors are demanding more and better information on climate and ESG, and that demand is not being met by the current voluntary framework. Not all companies do or will disclose without a mandatory framework, raising the cost, or resulting in the misallocation, of capital.

The SEC also announced the creation of a climate task force within its enforcement division that will “identify any material gaps or misstatements in issuers’ disclosure of climate risks,” and is seeking public comment as it updates rules around how publicly traded companies disclose climate risks.

This week, Treasury Secretary Janet Yellen announced a new Climate Hub within the Treasury Department that will “Bring to bear the full force of the Treasury Department on domestic and international policymaking, leveraging finance and financial risk mitigation to confront the threat of climate change.”

Meanwhile, the Biden administration is expected to announce an executive order directing several federal agencies to respond to climate risks. Politico reported that “President Joe Biden is preparing to instruct federal agencies to take sweeping action to combat climate-related financial risks to government and the economy.” Bloomberg News and E&E News also reported on the expected executive order.

Major investor groups find Berkshire Hathaway fails to disclose climate risks

The efforts by financial regulators to better understand and respond to climate risks reflect both the Biden administration’s climate agenda and growing concerns from institutional investors about how the companies they own are responding to the climate challenge. Berkshire Hathaway, the conglomerate led by Warren Buffett, is among the companies that appears to be falling far short of large institutional investors’ expectations for climate risk disclosure.

Berkshire Hathaway shareholders will consider the climate risk proposal, which is supported by California Public Employees Retirement System, Federated Hermes and Caisse Et Placement Du Quebec, at the company’s annual meeting on May 1.

In a supporting statement for the proposal, the shareholder groups explain:

Climate change and the energy transition to a low-carbon economy pose a systemic risk to the economy. Many risks are already taking effect, impacting the value of companies across multiple sectors. All companies should recognize and appraise physical and transitional climate risks. These risks and the board’s approach to their management, including any plans to achieve net-zero emissions, should be disclosed to enable these to be appraised by investors. We consider the Company’s current level of disclosure to be insufficient for investors to fully appraise its material climate-related risks and opportunities.

The Berkshire Hathaway board of directors opposes the shareholder proposal, arguing that “many of Berkshire’s subsidiaries are already making sound climate-related decisions,” and that an annual report on climate risks facing the company wouldn’t work well with Berkshire Hathaway’s decentralized structure.

The shareholder groups asked the Berkshire Hathaway board to reconsider its opposition to the proposal, and also noted that “we will ask Deloitte as your financial auditor to address how it independently evaluates company climate-related financial disclosures, risk, and opportunities at Berkshire.”

A much larger group of investors also recently highlighted Berkshire Hathaway’s failures in its approach to climate change. Last month the Climate Action 100+ coalition, which includes hundreds of investors that collectively manage assets worth more than $54 trillion, published assessments of 159 major emitting companies’ climate plans and performance. While most companies scored poorly, and all U.S. electric utilities failed to meet the investors’ expectations on lobbying and investment plans, Berkshire Hathaway was among the few companies that totally failed in every criteria.

Majority Action, an organization that works with shareholders to hold corporations accountable on climate risks and other issues, also urged shareholders to vote against Warren Buffet at the Berkshire Hathaway annual meeting because of the company’s failure to establish a net zero target, align its investment plans to limit global warming to 1.5°C, or ensure its lobbying efforts support those goals.

Berkshire Hathaway Energy is the largest U.S. power company without a net zero goal

Over the last two years, most major investor-owned electric utilities in the U.S. have announced net zero goals. While most of those goals are too slow to meet President Biden’s goal of decarbonizing the electricity sector by 2035, the goals reflect the utilities’ response to investors’ and customers’ expectations.

Yet unlike most other large investor-owned U.S. electric utilities, Berkshire Hathaway Energy has not announced a net zero goal. Berkshire Hathaway Energy is the fifth largest carbon polluting power company in the U.S., according to MJ Bradley’s latest annual Benchmarking Air Emissions annual report, and the eighth largest in terms of power generated.

Pacificorp, Berkshire Hathaway Energy’s subsidiary which sells power in Utah, Oregon, Wyoming, Washington, Idaho, and California, generated 48% of its energy from coal in 2020.

Pacificorp plans to increase its investments in renewable energy and close some of its coal plants. But the utility’s integrated resource plan leaves other coal plants running beyond 2030.

Pacificorp received an “F” grade in a report published by the Sierra Club and UC Santa Barbara Professor Leah Stokes, which found that the utility’s plans leave it with the most remaining coal without a 2030 retirement commitment of any U.S. electric utility.

The Sierra Club says Warren Buffett’s PacifiCorp, which serves customers in six western states, is on track to be burning more coal in 2030 than any other U.S. utility: https://t.co/5bu7pc0cEX via @petedanko

— Sammy Roth (@Sammy_Roth) January 26, 2021

Pacificorp also owns stakes in coal mines, which supplied 16% of the utility’s total coal consumption in 2020.

MidAmerican Energy, Berkshire Hathaway Energy’s subsidiary in Iowa, highlights its significant investments in wind energy – but it has not yet established closure dates for its coal plants.

Berkshire Hathaway Energy subsidiaries have also increased their investments in gas infrastructure. Last year the company purchased a major gas pipeline network, which CNBC reported means that “Berkshire Hathaway Energy will carry 18% of all interstate natural gas transmission in the United States.” The purchase added to Berkshire Hathaway Energy existing gas pipeline networks including Northern Natural Gas, the largest in the U.S. (measured by pipeline miles), and Kern River, which delivered about a quarter of California’s gas demand in 2019.

Berkshire Hathaway Energy lobbyists have also pushed a proposal to build ten new gas plants in Texas.

Beyond its energy subsidiaries, other Berkshire Hathaway subsidiaries also remain invested in fossil fuels.

Berkshire Hathaway’s insurance subsidiary is among the insurance companies that “continue to underwrite coal, oil and gas without any restrictions,” according to a report from Insure Our Future.

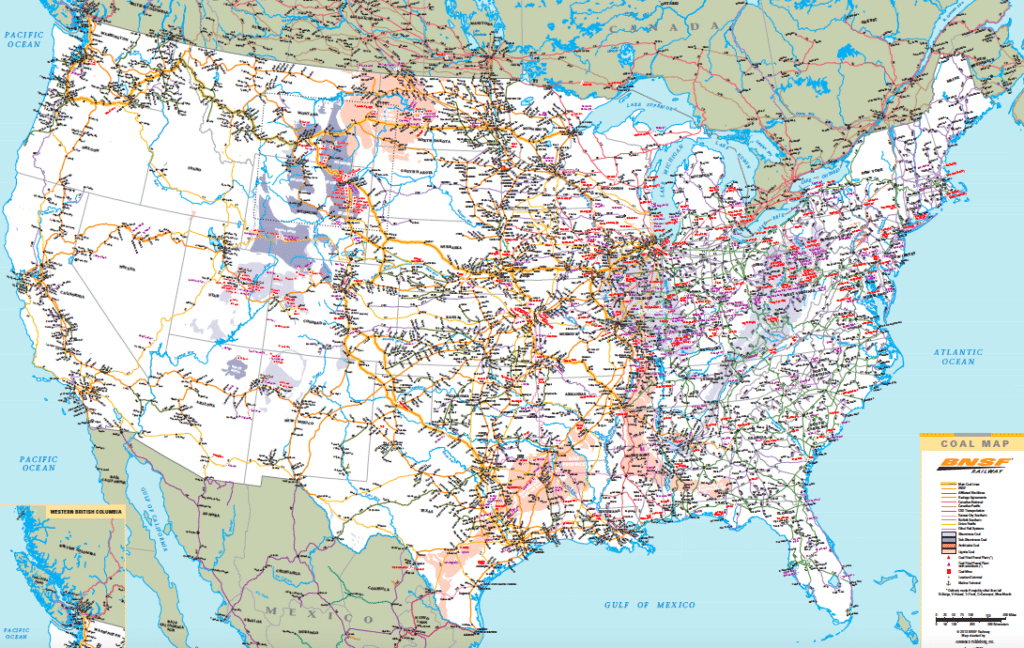

And BNSF is a major rail carrier of coal, and along with Union Pacific is the most exposed to weakening thermal coal demand, according to a Moody’s report.

Berkshire Hathaway Energy utilities pushed policies to discourage distributed solar

Berkshire Hathaway Energy lobbyists have also supported policy proposals in several states that would have discouraged the growth of distributed solar projects.

Most recently, Berkshire Hathaway Energy’s subsidiary in Wyoming, Rocky Mountain Power, supported a bill in that state that would have ended net metering, and could have killed the state’s solar industry, according to the Wyoming Outdoor Council. At a Wyoming Senate committee hearing, Rocky Mountain Power lobbyist Jon Cox said that “Our company does support this legislation.”

After widespread public opposition in legislative hearings, the bill failed last month.

MidAmerican, Berkshire Hathaway Energy’s subsidiary in Iowa, supported a legislative effort in that state in 2019 that would have added additional fees on customers that install solar arrays. The Edison Electric Institute, the trade association for investor-owned utilities, also promoted the Iowa bill, which passed the Iowa Senate but ultimately died in the House.

NV Energy, Berkshire Hathaway Energy’s subsidiary in Nevada, pushed that state’s Public Utilities Commission to end net metering in 2015, but strong public opposition against the decision ultimately resulted in bipartisan legislation and a decision by new PUC commissioners that restored net metering in Nevada. The fight over net metering in Nevada also spurred HGTV star Jonathon Scott to produce “Power Trip,” a film about monopoly utilities’ attacks on residential solar policies.

Berkshire Hathaway Energy subsidiaries are exposed to climate change impacts

In addition to Berkshire Hathaway Energy’s exposure to climate transition risks from its fossil fuel investments, the company is also exposed to physical climate risks, such as fires, drought, and stronger storms.

In a report presented at the Edison Electric Institute Financial Conference in November 2020, Berkshire Hathaway noted some of the weather events that impacted Pacificorp in just the month of September 2020, including hurricane-force winds in Utah, several major wildfires in California and Oregon, and damage to hundreds of transmission and distribution poles.

Pacificorp coal plants also consume more water in the arid western U.S. than those of any other power provider; those plants are subject to growing supply risks and conflicts as climate change fuels hotter and drier conditions in the region.

In Iowa, a derecho storm in August 2020 “caused $56 million in damage to MidAmerican Energy’s electric system.”

[…] ‘identify any material gaps or misstatements in issuers’ disclosure of climate risks’,” reports the Energy & Policy […]

[…] supporting the resolution, including California Public Employees’ Retirement System, explicitly noted: “We consider the Company’s current level of disclosure to be insufficient for investors to […]