In keeping with Donald Trump’s mission to bail out the coal industry, Department of Energy Secretary Rick Perry has asked the Federal Energy Regulatory Commission (FERC) to provide bailouts to power plants that no longer can compete with natural gas and renewable energy in the wholesale power market on the false basis that they will solve a grid resiliency crisis that does not exist. The proposal is intended to subsidize coal and nuclear plants, both of which are expensive and have been causing utility operators and coal mining companies to lose money.

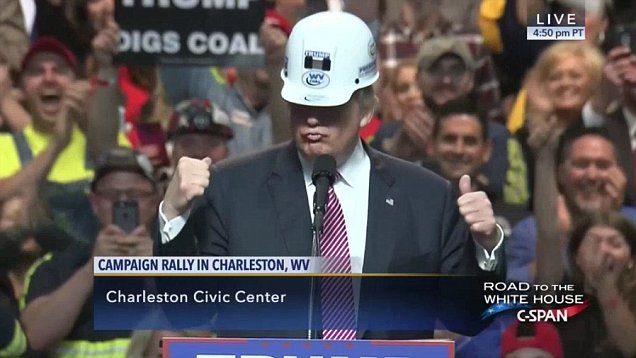

‘Trump Digs Coal’ at Charleston Rally (CSPAN)

Perry has filed a proposed rulemaking that asks the federal regulators (two of which are Trump appointees, with an additional two more pending Senate approval) to approve of the rule in order to allow power market operators to establish a new tariff for power plants that have a 90-day fuel supply on site – a naked nod to coal and nuclear plants.

The requirement to have a 90-day fuel supply on site echoes what coal and utility interests advocated for while speaking at energy conferences last week.

Paul Bailey from the American Coalition for Clean Coal Electricity (ACCCE) spoke at the Southern States Energy Board conference in Charleston on September 26 and said:

“Depending on which coal plant it is, it has somewhere between a 70- and 80-day supply of coal sitting there on site. That is fuel security. You’ve heard DOE Secretary Perry talk about fuel security – that’s fuel security right there …

“We think very strongly that the coal fleet is undervalued because – for a number of reasons, including that a large pile of coal sitting there on site, if you have a problem, that’s a good insurance policy.”

After the release of the proposed rule, Bailey applauded DOE and said, “We commend Secretary Perry for initiating a rulemaking by FERC that will finally value the on-site fuel security provided by the coal fleet. The coal fleet has large stockpiles of coal that help to ensure grid resilience and reliability.”

ACCCE members include coal mining companies, railroad companies, along with electric cooperatives and two of the largest utility companies, American Electric Power and Southern Company.

West Virginia Coal Association President Bill Raney echoed similar remarks last week when speaking at the Annual Coal Marketing Days Conference on September 26 in Pittsburgh.

Raney led the discussion titled, “Washington’s New View on Coal – Reversing Regulations in an Effort to Assist Fossil Fuel.”

Raney told the audience that the future of the coal industry was “created on November 8th.” He listed how the country has withdrawn from the Paris Climate Treaty, the regulations the administration has repealed, and that together with the DOE Report on Electricity Markets and Reliability he is seeing a “tremendous attitude change” and a “positive atmosphere” in Washington.

But in order to further level the playing field in the electricity market, Raney said he would also like to see more coal piled up outside of power plants:

“You can’t see the gas lines. You can’t see wind. You can’t see solar. So maybe we need to talk about having a requirement for power plants in order to ensure reliability of at least having a 30 to 60 day supply of fuel on hand. That is very practical and significant.”

Members of the West Virginia Coal Association include mining and railroad companies but also American Electric Power and FirstEnergy, which also released a statement that supported the rule upon its release.

Raney listed the many individuals that have been hired and nominated for positions within the Trump administration that are working to help the coal industry. He highlighted EPA Administrator Scott Pruitt, Secretary Ryan Zinke, and Secretary Rick Perry and again mentioned the grid reliability report.

Raney additionally listed Landon “Tucker” Davis as the coal policy advisor in the Department of Interior, Steve Winberg from CONSOL Energy and Doug Matheney from the Count on Coal Initiative within the Energy Department, and Dave Zatezalo of Rhino Resources to run the Mine Safety and Health Administration.

Other individuals that Raney didn’t highlight, but who also have connections with the utility and coal industry, include Brian McCormack (formerly of the Edison Electric Institute), David Banks (former lobbyist for Exelon), Mark Menezes (former lobbyist for Southern Company and other utilities), and Travis Fisher (formerly of the fossil fuel-funded Institute for Energy Research).

EEI’s Philip Moeller – FERC’s second-longest serving member, from 2006 through 2015. (Twitter)

McCormack is a former executive at the Edison Electric Institute (EEI) and Perry’s current chief of staff at DOE. Perry’s proposal to FERC quotes from a recent pro-coal and pro-nuclear study funded by three trade associations, including EEI, as justification for the rule. The other trade associations behind the study are the U.S. Chamber of Commerce, with utility and nuclear companies on its board, and the Nuclear Energy Institute.

After the release of the trade association-funded report, EEI Executive Vice President Phil Moeller, a former FERC Commissioner, said, “wholesale electricity markets should address price formation and the valuation of essential reliability services for customers.” And after the release of the DOE proposed rule, EEI released a statement that was supportive of Perry’s request.

David Banks, a former lobbyist for Exelon and now a special advisor to Trump, authored a report in 2014 that was critical of demand response, renewable energy, and natural gas in wholesale markets because “non-subsidized plants – including nuclear and coal units – are disadvantaged.” He called for FERC to “adequately compensate assets that provide critical services to the grid and address the impact of subsidies on energy markets.”

Exelon’s CEO Chris Crane, vice chairman of the Edison Electric Institute and immediate past chairman of the Nuclear Energy Institute (CNBC)

Exelon’s CEO Chris Crane called for a similar recommendation in an interview with UtilityDive earlier this year: “[Nuclear] provides more benefits than just megawatts … The resiliency, fuel diversity — it’s important that is factored into price formation.” Exelon also released a statement thanking Rick Perry for the proposal and highlighted the EEI, Chamber of Commerce, and NEI report as the rationale for FERC to finalize a rule.

The DOE proposal suggests that now-retired coal plants were crucial to the grid’s operation during the polar vortex, a false accounting which elides the fact that coal stockpiles froze during the vortex, and wind energy, efficiency and demand response were instrumental to keeping the lights on then, as noted by the Natural Resources Defense Council.

The DOE proposal asks FERC to act within 60 days, but the federal regulators are under no obligation to act within that timeline.