Utility Carbon Targets Reflect Decarbonization Slowdown In Crucial Next Decade

Many of the nation’s largest utilities are planning to slow down their efforts to decarbonize their electricity generation over the next decade compared to the previous one, threatening the ability for the U.S. to respond to the climate crisis at the speed that scientists say is necessary to avoid its worst effects.

Electric utilities lie at the crux of the effort to decarbonize the U.S. economy, which involves two steps: the first is to move all electric generation to zero-carbon sources of electricity. The second is to switch everything that’s currently fueled directly by oil or gas, like cars and trucks, onto that carbon-free electricity.

Most U.S. utilities have decreased the carbon dioxide that they pollute directly from power plants over the past decade, mainly by retiring coal-burning power plants. But between now and 2030, these same companies are planning to slow down their rates of decarbonization, according to a new analysis of the utilities’ goals.

The slowdown is surprising for several reasons: renewable energy sources like wind and solar are now the lowest-cost ways to generate electricity in vast swaths of the country, cheaper than coal and in many cases, gas. At the same time, the last ten years of climate science have shown that the need for rapid emissions reductions is more crucial than ever.

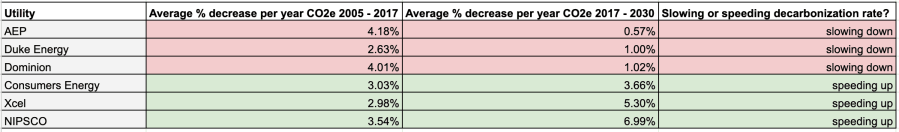

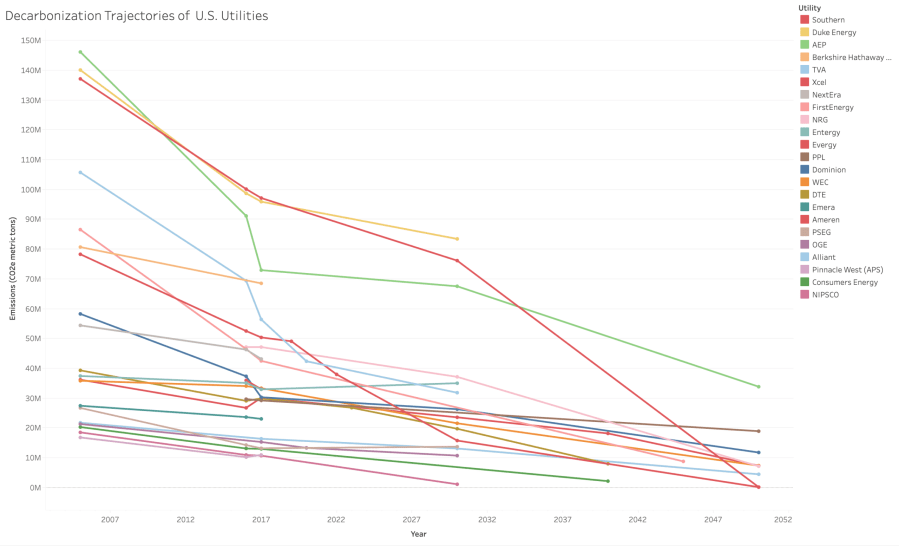

Yet despite the availability of renewable energy and the dire scientific warnings, the pace of decarbonization for the country’s largest utilities will slow just at the moment it must accelerate. An analysis by the Energy and Policy Institute of the carbon targets of the 22 highest emitting investor-owned electric utilities by carbon emissions, plus the federally owned Tennessee Valley Authority (TVA), showed that eleven utilities plan to slow down their rates of decarbonization over the 2017-2030 time period compared to the 2005-2017 time period, including three of the country’s top carbon polluters: Duke Energy, Southern Company and American Electric Power. The data also shows a fissure beginning to open in the sector: six utilities plan to accelerate their decarbonization. Five of the utilities analyzed did not set any decarbonization targets at or near 2030. (1)

The dataset for EPI’s analysis is available here. Data visualizations are available here.

Shareholders drive carbon commitments from companies

In the absence of federal climate policy, most of the utilities have been motivated to set the carbon targets in the past two years in large part by investors, who have expressed growing concern about the risks posed by climate change to the sector.

Shareholder activists have increasingly and successfully submitted resolutions in recent years demanding that utilities provide assessments of how they would fare if policies were enacted to keep global warming to under 2° Celsius, the maximum goal set by the 2015 Paris Agreement. (The accord actually aims for “well below” 2°, and to pursue efforts for 1.5°.)

Some powerful institutional investors escalated that pressure in February 2019, when pension funds with $1.8 trillion of assets under management, led by the New York City Comptroller, asked utilities to go carbon-free by 2050.

“The climate crisis is an imminent threat not only to our planet, but to pensions systems, and ultimately, our beneficiaries,” New York City Comptroller Scott M. Stringer said. “These are the biggest power producers and polluters in our country, which is why decarbonization is not just a moral imperative, it’s a financial necessity.”

Additionally, a younger generation of investors are considering climate change in their investment calculus. A 2017 Morgan Stanley study found that nine of 10 millennials want to invest in socially responsible portfolios. That trend has caught the attention of the electric utility industry.

“Investors are increasingly interested in the risks associated with climate change,” said one internal briefing from the Edison Electric Institute, the trade association for investor-owned electric utilities. The presentation, which Ameren shared with one of its regulators in Missouri, cited estimates from the accounting firm PwC that “a $30 trillion wealth transfer from Baby Boomers to Generation X and Millennials will occur over the next several decades,” and that “86% of millennials are interested in socially responsible investments, and 90% desire sustainable investing options in their 401(k) plans.” But while most utilities have packaged their carbon goals as climate progress to investors, the data of their actual historical performance and forward-looking goals shows that they are planning to let that progress slacken, in some cases dramatically.

Most large utilities plan to decarbonize more slowly from 2017 – 2030 than 2005 – 2017

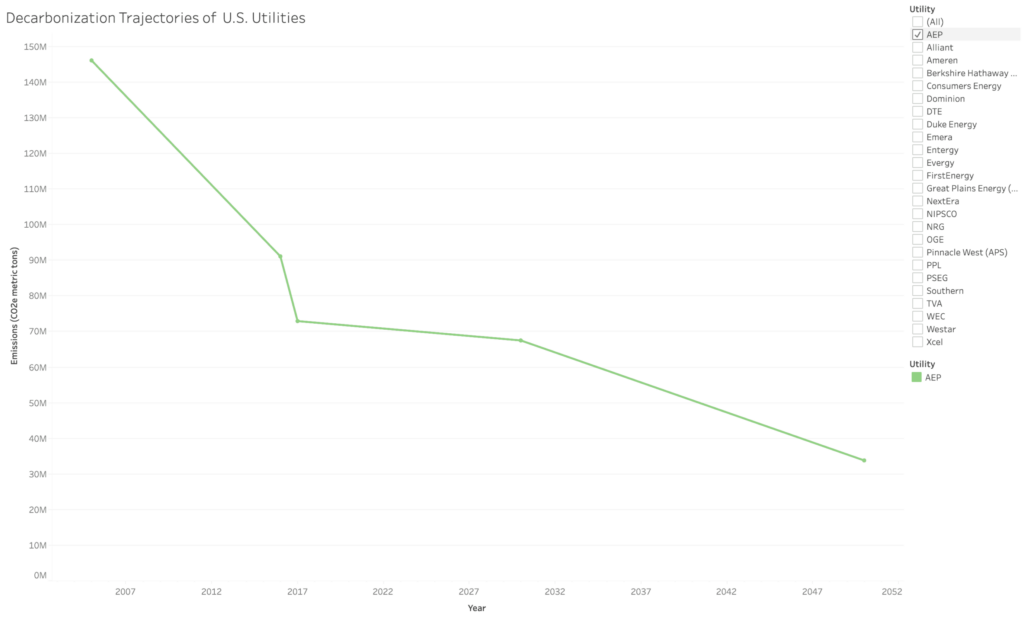

American Electric Power, one of the largest utilities in the country and the fourth-biggest emitter of carbon emissions in 2017 according to a survey of EPA data by MJ Bradley, set a goal in February of 2018 to reduce carbon emissions from its power plants by 60 percent by 2030, and 80 percent by 2050, from a baseline year of 2000.

Absent data and context, the goals appear impressive, and AEP has pitched them to investors as forward-thinking:

“Our investors want us to protect their investment in our company, deliver attractive returns and manage climate-related risk. This long-term strategy allows us to do both,” AEP chairman Nick Akins said in February 2018 when the company announced the goals.

But at the time it set that goal, AEP had already decreased its carbon emissions by about 57 percent since 2000, by retiring some coal plants and selling off other merchant coal plants that were no longer profitable to private equity firms. The progress that AEP made in the previous decade masks the sluggish pace of its forward-looking goal – set by the company after those reductions were already achieved – which requires it to reduce its 2017-level carbon emissions by a mere 7 percent from its 2017 level by 2030. The annual rate of AEP’s planned decarbonization from 2017 – 2030 will be 0.6% per year, seven times slower than the 4.2% decarbonization rate it achieved from 2005 – 2017, as seen in the flat line from 2017 to 2030 in the graph below.

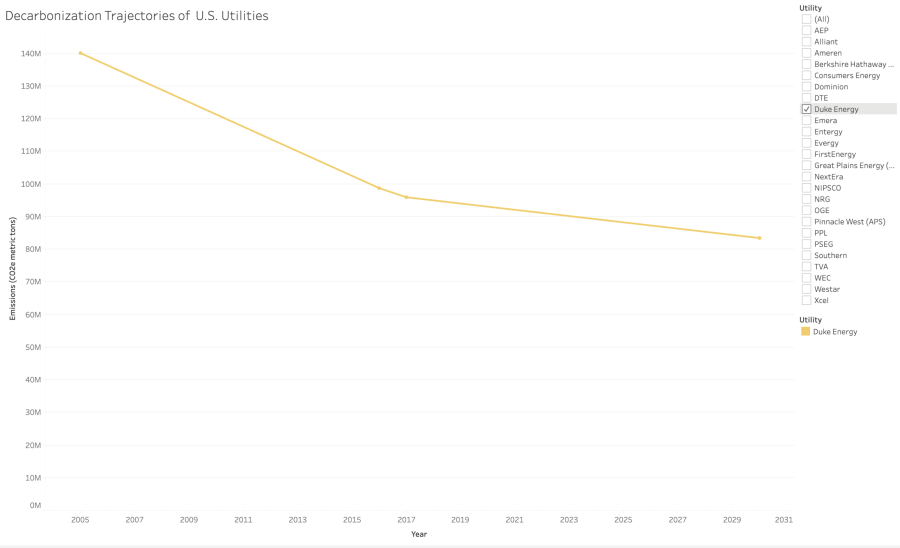

Duke Energy, the single largest emitter among utilities, similarly set a goal in April of 2017 of reducing its emissions 40 percent by 2030, also from a 2005 baseline. But Duke had already achieved a 31 percent reduction from 2005 – 2017. Duke’s plan requires it to reduce its 2017-level carbon emissions by only 13 percent by 2030 – its annual decarbonization rate will be 2.6 times slower over the next 13 years compared to the previous 12-year period.

When it set the goal in 2017, Duke said that “the company’s planned investments over the next decade will build on that progress and further reduce emissions,” despite the fact that the goal would allow it to cut the pace of decarbonization so dramatically.

Gas investments at the root of the slowdown

Given that renewable energy and battery storage are cheaper than ever, and the need for carbon reductions to address climate change is more urgent as ever, why would utilities like AEP or Duke be slowing down their decarbonization?

One likely answer is that utilities are preserving their ability to continue building gas-burning plants. Duke, which has operations in the Carolinas, Florida, Ohio, Indiana and Kentucky, provides a useful case study. The utility reduced its carbon footprint from 2005 to 2017 by shuttering old coal plants, but by 2033, it plans to build 9,534 MW of gas capacity in the Carolinas alone, according to UtilityDive. Duke will add only 3,671 MW of solar capacity in the Carolinas across the same timeline.

“As we retire old coal, in most cases we will replace that with natural gas,” a Duke spokesperson said of its plans.

Synapse Energy Economics modeled an alternative plan for Duke Energy on behalf of the North Carolina Sustainable Energy Association and GridLab that did not call for any new gas plants and reduced coal dramatically, instead leaning on solar energy and batteries. The analysts found that scenario would cost customers less and dramatically reduce emissions.

Duke Energy also operates in Indiana, where it has signaled that it will seek permission to invest in 2,480 MW of new gas plants in a forthcoming resource plan due to regulators next week (see page 12).

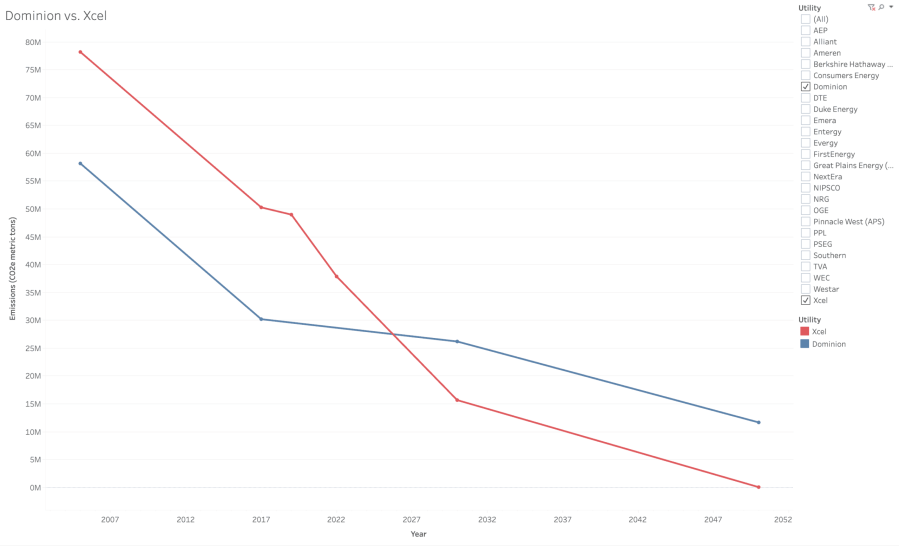

Dominion Energy has been on a similar gas-building spree in Virginia, likely contributing to that company’s planned decarbonization slowdown, according to a new goal it released in March. The company held a special session for “ESG,” or “Environment, Social, Governance” investors on March 25, where it told them about its first-ever emissions goals of an 80% reduction by 2050 and a 55% reduction by 2030, both from 2005 levels.

As is the case with AEP and Duke Energy, that reduction would represent a significant slowdown in Dominion’s decarbonization rate. From 2005 to 2017, Dominion reduced its carbon emissions at an average rate of 4% per year, mostly by retiring coal plants in the past several years. That rate plummets to 1% per year between now and 2030 based on Dominion’s new goal.

Sector-wide data echoes the notion that the utilities are not decarbonizing quickly enough due to gas investments. The U.S. Energy Information Administration (EIA) says that carbon emissions from U.S. power plants increased by 1 percent from 2017 to 2018, making last year the first time that year-over-year power plant carbon emissions have increased since 2013. EIA data suggests that the increase is due to utilities’ heavy embrace of gas. Utilities’ owned gas-fired generation increased by 90,000 megawatt-hours in 2018 compared to 2017. Utilities’ owned solar generation increased by only 1,900 megawatt-hours during the same period.

| 2017 | 2018 | Increase | |

Utility-owned Gas Generation (MWh) | 623,835 | 714,303 | 90,468 |

Utility-owned Solar Generation (MWh) | 3,348 | 5,252 | 1,904 |

The rush to build gas plants, instead of renewable energy and storage, could cost customers hundreds of billions of dollars, according to an analysis by the Rocky Mountain Institute (RMI). (Other analyses similarly suggest that gas plants will become costly stranded assets in a world of rapidly growing distributed energy systems.)

Utilities that are skipping gas have more aggressive decarbonization goals

Not all of the utility companies surveyed are slowing down their decarbonization efforts or pursuing a gas strategy. A clear divide has opened between decarbonization leaders and laggards.

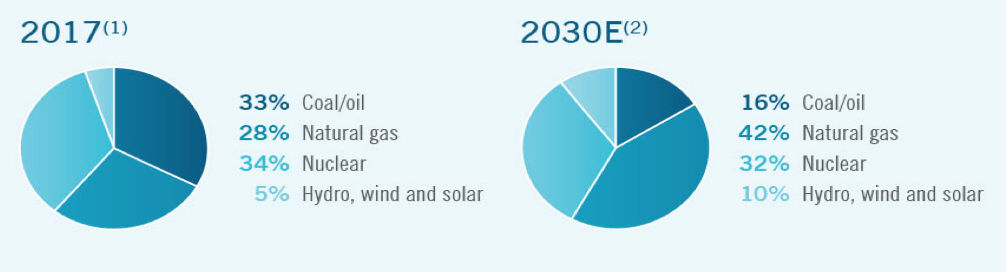

Xcel Energy is one of the country’s largest electric utilities, with operations in eight states, primarily Colorado and Minnesota. Xcel pledged in December, 2018 to reduce its carbon emissions 80 percent by 2030 from 2005 levels, and to fully decarbonize by 2050. Xcel’s new goal is an upgrade of a previous one to cut carbon emissions 60 percent by 2030. It says its plans to lean heavily on renewable energy and batteries will save its customers money. In a detailed report released in March, Xcel says its goals fall within the range compatible with IPCC scenarios that achieve either a 2°C or 1.5°C target.

Graphing Xcel’s trajectory vs. Dominion’s is telling: the companies’ decarbonization pathways tracked one another closely from 2005 until 2017. At that point, Xcel’s trajectory starts turning sharply downward, while Dominion’s flattens out.

An Indiana utility, NIPSCO, says that it will reduce carbon emissions by “more than 90%” by 2028 from a 2005 baseline. While other utilities are claiming that they need to build gas plants to manage their transition out of coal, NIPSCO has said that it will skip straight from coal to renewable energy. The company told Indiana regulators that of all the pathways it analyzed, skipping gas in favor of renewable energy was the one with the lowest cost to consumers.

Most utilities’ 2050 goals do not match IPCC analysis calling for full decarbonization of electricity

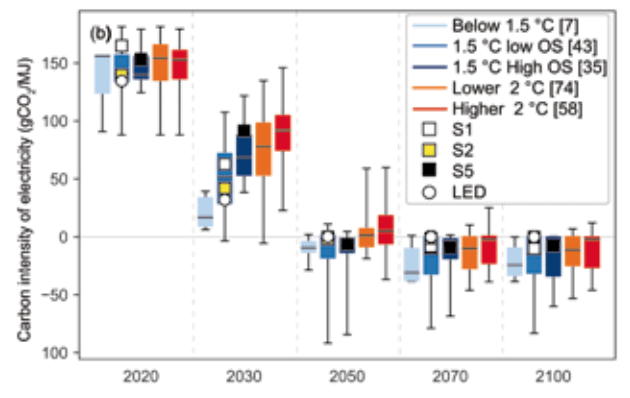

The Paris Agreement calls for limiting warming to “well below 2 degrees Celsius” with a further goal of 1.5° Celsius. The latest report from the International Panel on Climate Change (IPCC) spells out what that means for carbon emissions: global carbon emissions must be cut in half by 2030 and reach net-zero by 2050 to have even a 50 percent chance of reaching the 1.5° scenario.

The IPCC report gets more specific when it comes to electricity, noting that “A robust feature of 1.5°C-consistent pathways, as highlighted by the set of pathway archetypes in Figure 2.5, is a virtually full decarbonization of the power sector around mid-century, a feature shared with 2°C-consistent pathways.” (The additional cuts to get to 1.5°C come from the transport and industrial sectors, according to the IPCC. See page 112.)

Development. See (2) for full citation.

In other words, whether U.S. utilities are setting plans consistent with 1.5° or 2° scenarios – a difference that equates to extreme heat and sea level rise for hundreds of millions more people, full coral reef extinction, greater tipping point risks, etc. – either case requires global electricity to reach zero carbon by 2050.

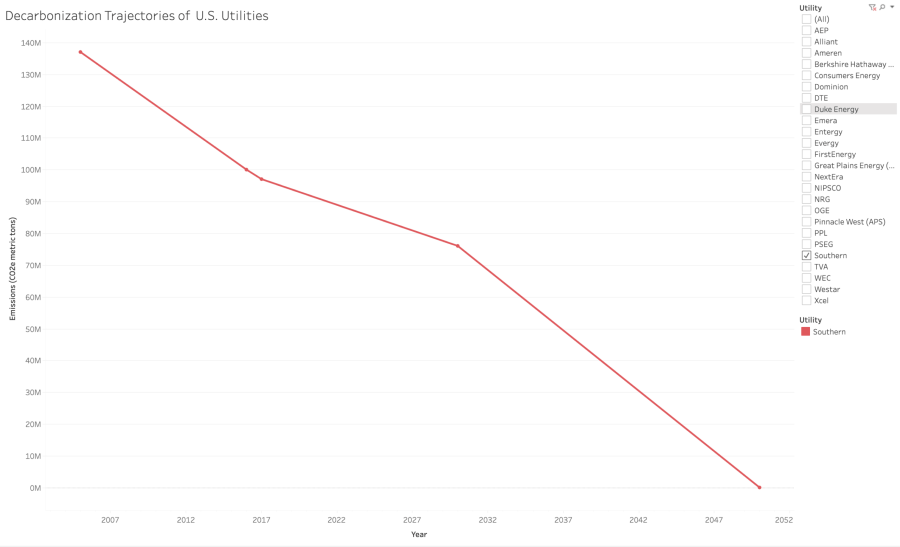

Southern Company’s “low- to no-carbon goal” seems dubious

Aside from Xcel, only Southern Company has set a goal of full decarbonization by 2050. Southern Company was the utility sector’s second largest carbon polluter in 2017. It pledged in April of 2018 to reduce emissions 50 percent by 2030 from 2007 levels, and to reach “low- to no-carbon operations by 2050.”

But Southern Company has not defined explicitly what “low-carbon” means. Its CEO later said that despite its “low- to no-carbon goal,” “there will still be fossil fuel resources on the company’s system, likely natural gas instead of coal.” Burning natural gas emits carbon.

Like AEP and Duke, Southern’s decarbonization trajectory also slows down from 2017 to 2030 compared to the 2005 to 2017 period, creating a dynamic where the company is leaving its steepest reductions to the 2030 to 2050 timeframe.

There are other reasons to take Southern Company’s “low- to no-carbon goal” at less than face value. Georgia Power, Southern’s largest subsidiary which accounts for 30% of the company’s carbon emissions, acknowledged in a filing with Georgia regulators last month that its parent company’s goals “did not influence the target amount of renewables” that Georgia Power proposed in its 20-year plan. Alabama Power executives have also made comments that indicate they may be ignoring the parent company’s carbon goals.

All other utilities that have set carbon emissions targets for 2050 are saying that they will still emit at least some carbon, despite the IPCC guidance.

Many companies have no goals whatsoever, or deceptive ones

A few major investor-owned utilities have still set no goals for emissions reductions whatsoever. The largest investor-owned utilities (by carbon emissions) without any emissions reduction goals are Berkshire Hathaway Energy, NextEra Energy and Pinnacle West.

NextEra and Pinnacle West have set emissions “intensity” goals, meaning they pledge to emit less carbon per unit of electricity that they sell. Those goals do not guarantee absolute emissions reductions of any specific magnitude. NextEra’s Florida subsidiary has invested heavily in gas-fired generation assets and an interstate gas pipeline in the state in recent years, and has told state regulators that even in 2027, it will rely on gas to generate 65 percent of its electricity. Pinnacle West’s subsidiary in Arizona told regulators that it wants to build thousands of megawatts of new gas plants, a plan that regulators refused to accept out of concern that the gas rush was unnecessary and more expensive than renewable energy and battery storage.

Other companies have used sleights of hand in their target-setting.

Entergy set an emissions intensity goal in March of 2019 which it said will result in a 28% absolute emissions reduction by 2030 from a 2000 baseline, but the company had already achieved that level of emissions two years prior, in 2017. Entergy openly acknowledged in its sustainability report that its goal is not consistent with a 2-degree pathway.

PSEG committed in February 2018 to “reduce 13 million tons of CO2-equivalent emissions by 2030, with 2005 serving as the baseline.” PSEG did not disclose in that press release its 2005 or current emissions levels, making an assessment difficult at face value. However, in separate reporting, PSEG recorded its 2005 emissions as 26 million tons of CO2-equivalent emissions. In other reporting to investors, PSEG listed its 2017 emissions as 13 million tons. In other words, the company committed to a 2030 “target” in 2018 that it had already achieved the previous year.

FirstEnergy Corp. has set a seemingly ambitious goal of reducing its carbon emissions 90 percent by 2045 from 2005 levels, but that goal does not cover the power it purchases, which formed 30 percent of its carbon emissions in 2017.

FirstEnergy Corp said in its 2019 Climate Report, that it “will no longer be accountable for the emissions associated with three additional fossil fuel-fired generation facilities” when its former subsidiary FirstEnergy Solutions emerges from bankruptcy, “resulting in further reductions to FirstEnergy’s CO2 emissions.” In other words, FirstEnergy Corp. is counting its loss of several fossil fuel plants through the bankruptcy of its generation subsidiaries as contributing to its emissions reductions goals.

Methodology

The Energy and Policy Institute examined the carbon goals of 22 investor-owned utilities based on their estimated 2016 carbon emissions according to a ranking compiled by MJ Bradley and Associates, which draws from data that the companies are required to report to the U.S. Environmental Protection Agency. EPI also included TVA, a federally owned corporation, due to its size and public status. AES is an investor-owned utility that would have qualified under those criteria, but which EPI excluded from the data set since the majority of its electric generating capacity is from outside the U.S.

EPI did not include independent power producers in the analysis. Dynegy and Vistra, two large emitters which recently merged, report very little data about their carbon emissions and have no decarbonization goals. EPI did not include them in this analysis.

All of the utilities’ past and current carbon emissions data came from the utilities’ own reporting, primarily from the companies’ use of a reporting template provided by the Edison Electric Institute.

For utilities that did not use that template, or that left holes in their reporting on the template, such as baseline year emission data, EPI used data either from the utility’s sustainability reports, or from their filings to CDP, a carbon disclosure organization. In a few cases, basic math was needed to fill in the data so that companies could be more easily compared to one another. For example, most companies use 2005 as a baseline year, in keeping with conventions of the Paris Agreement and President Obama’s Clean Power Plan. Southern Company set its baseline at 2007 and does not disclose its 2005 emissions data. It did, however, say that “Without federal mandates, total annual emissions in 2016 were approximately 27 percent lower than 2005 levels,” which EPI used to derive an estimate of its 2005 emissions.

Owned vs. Purchased Power Footprints

Utilities report to varying levels of specificity whether their carbon reduction goals apply only to the power plants they own, or also to the power that they purchase from third parties or wholesale markets and pass on to customers.

Most utilities indicated that their goals applied only to the emissions from their own power plants. In those cases, EPI only assessed emissions data from the utilities’ owned power plants. For utilities that made clear that their goals also applied to emissions associated with their purchased power and reported those emissions, EPI included that data in its analysis.

In some cases, like with Dominion, Entergy, FirstEnergy, Pinnacle West and PPL, a significant percentage of emissions in some years derived from power purchases, but the companies’ goals only applied or appeared to apply to their owned power plants. That means that the companies’ goals are leaving out large percentages of their overall carbon footprints.

Because EPI’s analysis focused on the carbon emissions that companies indicated are covered by their decarbonization goals, and from data reported by the companies to investors, the emissions data may vary from other similar datasets, like MJ Bradley’s, which uses data that the companies report to the EPA.

What’s not in the data?

It’s important to note that the data EPI analyzed do not include upstream emissions like methane leaks that occur from fracking or gas transmission en route to natural gas burning power plants.

The data also do not include greenhouse gas footprints from gas distribution companies that are subsidiaries of the utility companies. Many of the utilities in this dataset own significant gas utility operations and are not reporting the carbon emissions related to their customers’ use of gas. NIPSCO, for instance, has an ambitious plan to decarbonize its electric generation, but that plan does not cover the gas distribution subsidiaries that are also owned by NIPSCO’s parent company, NiSource.

Mergers

Some of the companies covered in this analysis were parts of mergers or acquisitions in 2018: NextEra bought Gulf Power from Southern Company; Dominion bought SCANA; Evergy formed via a merger of Westar and Great Plains Energy.

The most recent emissions data for NextEra, Southern Company and Dominion are from 2017, so the data and graphs here pre-date those mergers, though it’s worth noting that the carbon footprints of NextEra and Dominion will become significantly larger due to the acquisitions. Dominion’s carbon footprint will increase by approximately 29 percent, and NextEra’s will increase by approximately 22 percent. Southern Company’s carbon footprint will shrink.

Enough data existed to sum Westar and Great Plains Energy’s 2016 and 2017 emissions to arrive at total corporate data for Evergy. Evergy has said that the newly formed company would reduce emissions by 43 percent by 2020 from a 2005 baseline, but since only Westar (and not Great Plains Energy) reports its 2005 data, it’s impossible to assess Evergy’s forward-looking target.

Sales or bankruptcies of coal assets

Some of the utilities in the dataset have sold off their merchant coal plants in recent years, including AEP, Duke, NRG and PPL. FirstEnergy declared bankruptcy for its subsidiary FirstEnergy Solutions, which operated its merchant coal plants, in early 2018.

When the utilities sold those assets, they appear to be counting the removal of the coal plants from their books as progress just as if they’d retired the plants, even if the plants continued to operate under new ownership. From the standpoint of an investor evaluating carbon risk, that makes sense: shareholders can be satisfied that the companies have divested of those assets.

This analysis does not differentiate between utilities’ decarbonization that resulted from selling coal assets as opposed to from retiring them. However, other observers may want to consider how these sales affect a company’s goals. For instance, PPL noted that its goal of a 70 percent emissions cut by 2050 from 2010 levels would actually represent a reduction of only “45 percent counting only PPL’s current business mix.”

(1) NRG did set a 2030 target and is part of the dataset, but is not included in this list, since it has published historical emissions data dating only to 2014, which does not establish enough of a trendline to determine how its future target compares to past reductions. PPL’s earliest target date is 2050 and FirstEnergy’s earliest is 2045.

(2) Rogelj, J., D. Shindell, K. Jiang, S. Fifita, P. Forster, V. Ginzburg, C. Handa, H. Kheshgi, S. Kobayashi, E. Kriegler, L. Mundaca, R. Séférian, and M.V.Vilariño, 2018: Mitigation Pathways Compatible with 1.5°C in the Context of Sustainable Development. In: Global Warming of 1.5°C. An IPCC Special Report on the impacts of global warming of 1.5°C above pre-industrial levels and related global greenhouse gas emission pathways, in the context of strengthening the global response to the threat of climate change, sustainable development, and efforts to eradicate poverty [Masson-Delmotte, V., P. Zhai, H.-O. Pörtner, D. Roberts, J. Skea, P.R. Shukla, A. Pirani, W. Moufouma-Okia, C. Péan, R. Pidcock, S. Connors, J.B.R. Matthews, Y. Chen, X. Zhou, M.I. Gomis, E. Lonnoy, T. Maycock, M. Tignor, and T. Waterfield (eds.)]. In Press.

Top image is of the Sutton gas plant in North Carolina. Credit: Duke Energy flickr page, Creative Commons